Here’s data from the latest coal report from the US Energy Information Administration, taking us up through the first quarter of 2012:

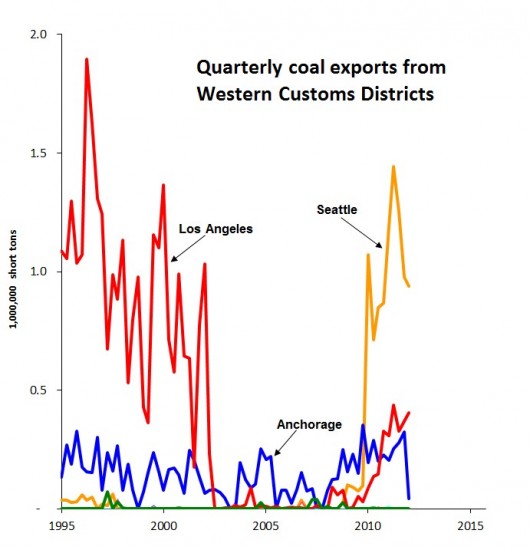

In the Western Customs Region, depicted above, three Districts reported meaningful quantities of coal exports:

- The Seattle District shipped 937,908 short tons of coal in the first quarter of 2012, which marked the third consecutive quarterly decline. (Down from the high-water mark of more than 1.4 million tons in the second quarter of 2011.) Cloud Peak Energy claims credit for all of this coal, “approximately 971,000 tons,” in its first quarter investor report.

- Coal shipments from the Los Angeles District bounced up by about 34,000 tons.

- The Anchorage District reported a steep drop-off to less than 42,000 tons of coal exports, a quarterly decline of 87 percent.

Interestingly, coal exports out of the Great Falls (Montana) Customs District remain at near-zero figures, which suggests that coal shippers are not using much of the spare capacity at the Ridley Terminals at Prince Rupert, BC. (Cloud Peak Energy says that it shipped just one vessel from Ridley during the first quarter of 2012, and expects to ship one more vessel during the second quarter.)

Overall coal exports for the West declined during the first quarter of 2012, marking the third straight quarterly decline in coal shipments for the region.

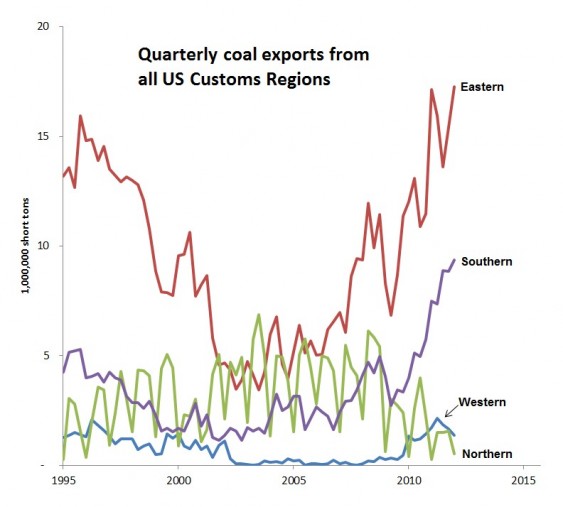

Nationally, coal export trends were bifurcated.

Northern Region coal shipments declined, but exports from the Eastern and Southern Customs Regions continued surging during the first quarter of 2012. Total US coal exports were up 3.5 percent, putting the country on track to possibly set an all-time coal export record in 2012.

It’s useful, however, to compare recent trends to the coal export plans for the Northwest. If those projects were built and operating at capacity, the Western Region could be shipping 36 million tons of coal per quarter, more than double even the exports from the Eastern Region.

The EIA is promising new quarterly data in September, and I’ll report on it here when it’s available.

Thanks to Pam MacRae for research assistance.

All of my reporting on quarterly coal export volumes can be found in the series “Coal Export Trend Reports.” All data come from the US EIA’s latest quarterly coal report, covering the entire Western Customs Region. In addition to the districts shown on the chart here, the Western Region includes the Portland, Great Falls, Nogales, San Diego, and San Francisco Districts. These districts have been reporting virtually no coal exports.

Please note: The first chart shows Customs Districts, not individual ports. The Port of Seattle does not move coal, for example, but some coal does get exported out of the Seattle Customs District by way of the rail crossing at Blaine, Washington. It is Powder River Basin coal heading to BC’s Westshore Terminal for onward shipment to Asia.