The Census Bureau is debuting a new version of its poverty count, the Supplemental Poverty Measure (SPM) that should represent an improvement over the old flawed version. The new measure is supposed to be broader and more reflective of factors like a family’s size, geographic location, and whether it is receiving benefits such as food stamps, energy assistance, a housing subsidy, or tax credits. Additionally, the new measure takes into account expenses a family might have, including taxes, child care, transportation, and out of pocket medical expenses.

The Census Bureau is debuting a new version of its poverty count, the Supplemental Poverty Measure (SPM) that should represent an improvement over the old flawed version. The new measure is supposed to be broader and more reflective of factors like a family’s size, geographic location, and whether it is receiving benefits such as food stamps, energy assistance, a housing subsidy, or tax credits. Additionally, the new measure takes into account expenses a family might have, including taxes, child care, transportation, and out of pocket medical expenses.

Surprisingly, the new measure revises the poverty rate for renters down but bumps up the number of homeowners in poverty. To understand why, let’s dig into the details a bit.

A paper by Kathleen Short on the research that shaped the SPM found that the new measure changes both how many people are classified as in poverty—there are more—and also the kinds of people that would now be considered poor. For example, the new measure identifies more elderly people as being in poverty. Overall, the new measure would revise the current percentage of people in poverty up from 14.5 percent to 15.7 percent.

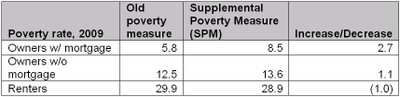

One thing caught my eye in the details: renters look better off under the new measure. The survey broke out housing occupants into two categories: owners and renters (and broke out owners into two additional categories, those with mortgages and those without). Interestingly, after applying the new measure, the poverty rate for owners goes up while the rate for renters goes down.

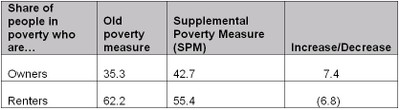

The old measure found that 35.3 percent of all people in poverty are homeowners while 62.2 percent of all people in poverty are renters, but the new measure shows a different composition among the poor: fully 42.7 percent are owners and just 55.4 percent are renters.

There are a number of things at work here. First, as a Bureau of Labor Statistics presentation points out, many low income families own their own homes without a mortgage. Having the title free and clear doesn’t necessarily mean that a household is immune from falling into poverty but, on the other hand, the new measure correctly tries to pick up on the fact that households without mortgages may have substantially lower housing costs. On balance though, owners across both homeowner categories (those with mortgages and those without) end up with higher poverty numbers than they had with the old measure. Why would that be?

Another reason might be SPM’s more careful treatment of the elderly. As Short points out, the number of older people under the poverty line increased using the new measure. Often older people might indeed own their own home free and clear, but still face a drag on income from property taxes; and their incomes are often limited to social security and retirement benefits. The new measure picks up these shifts among the elderly, and that helps account for why it finds more homeowners in poverty.

By contrast, the new measure shows lower figures for renters. One reason for this could be that the SPM captures housing subsidies as part of the non-cash benefits that some households get. That means that renters who receive Section 8 subsidies, for example, get those subsidies counted on the positive side of their poverty ledger. (The old measure doesn’t pick up housing or other types of subsidies in its calculation of poverty—it just looks at cash income.)

Another possibility—and this is pure speculation on my part—connects back to my last post on the definition of affordable housing. Could it be, overall, that renters—who often live in multifamily housing—are more self-sustaining than homeowners? Is it more affordable—even without subsidies or non-cash housing benefits—to live in an apartment down town than own a house in an outlying area?

There’s no way to say definitely yet because the new standard has only just this year been rolled out. In fact, I am currently reviewing another report on the SPM and how it considers subsidized housing. It’s worth keeping an eye on how the SPM gets used because I suspect it will be instructive to discussions about how we define affordability. And it may help us see whether what I’ve been suggesting—that compact communities are more affordable than we think, even for people who don’t own their homes—is true.

Photo credit: cohdra from morguefile.com

Comments are closed.