As domestic demand for coal has tumbled, the coal industry has grown increasingly desperate to shore up falling revenues by exporting coal to Asia. And that’s why there have been so many controversial proposals to develop coal export terminals in the Pacific Northwest: the industry thinks that the Northwest offers the cheapest route to move coal from Montana and Wyoming to China, Korea, and Taiwan.

One company, the Australian-based Ambre Energy, Ltd., has put itself in the center of the coal export brouhaha by launching plans to build two major coal export terminal projects on the Columbia River. The larger of the proposed terminal projects, at a brownfield site in Longview, WA, would handle up to 44 million tons of coal per year. The smaller project, proposed to ship coal by rail to Oregon’s Port of Morrow and then barge it downstream to ocean-going vessels at Port Westward, would handle up to 8 million tons of coal annually. Both projects face major permitting, regulatory, and financing hurdles before they can get off the ground, let alone turn a profit.

But while some of the other players in the coal export game are relatively well known, there’s surprisingly little reliable information in circulation in the Northwest about Ambre Energy. The company’s history, its track record, and its finances remain something of a mystery to the businesses and communities that would be affected by their coal export proposals, and to decision-makers who are deciding how to navigate the controversy. Because there’s so little information about the company out there, many people in the Northwest assume that Ambre is a major international coal company with a significant track record in the global energy industry.

But we just completed an in-depth review of Ambre’s finances, and found a story of a company with no track record of success, deeply troubled finances, minuscule overseas assets, and just over one years’ worth of experience in the US coal industry.

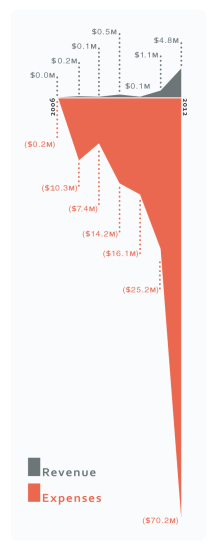

The chart to the right is pretty self-explanatory: the company has racked up massive expenses over the last seven fiscal years, with minimal revenues.

In short, Ambre’s finances paint a picture of a high-risk startup, rather than a stable and reliable business. The company has been losing money on risky energy investments in the US and Australia since 2005. And it didn’t even start producing coal commercially anywhere in the world until late 2011, when it bought an under-performing mining business from a US company angling to get out of the coal industry. Ambre has never come anywhere close to earning a profit, and instead has racked up massive losses for its investors—including $65 million in 2012 alone.

Here are some of the other findings of our review of Ambre’s track record and finances:

- Minuscule revenues. Ambre has collected only $6.6 million in worldwide revenues over the past 7 years.

- Massive losses. Ambre has accumulated $124 million in losses (or “negative retained earnings”) on its balance sheets.

- High borrowing costs. The company has taken out multi-million dollar loans with annual interest rates of at least 10 percent, and a “balloon” loan charging 12 percent—strikingly high rates when even high-risk “junk” bonds earn yields of 6 percent.

- Huge liabilities. The company is on the hook for hundreds of millions of dollars for mine reclamation and site cleanup, for retiree medical and pension benefits for recently acquired companies, and for purchasing a coal mine as a part of a recent legal settlement.

- Troubled assets. Ambre may see little value from some of its assets, including a $65 million cash holding dedicated for mine reclamation, and $19 million in shale oil development costs.

- Massive capital needs: Ambre needs to raise about $1 billion to bring its coal export plans to fruition.

- Failed Australian venture. The firm recently admitted that it lost $10.9 million on a failed coal project in Australia.

- Regulatory uncertainty: Ambre faces massive regulatory and permitting uncertainties, including lengthy state and federal environmental reviews, mine reclamation requirements, and new questions about its plans to sell coal among subsidiaries at low prices to reduce federal royalty payments.

Read the whole thing, here! And while you’re at it, consider reading what some other people have had to say about Ambre Energy.

Comments are closed.