Both Oregon (Portland) and Washington (Seattle and Bremerton) have HOPE VI projects, the latest generation of public housing. (HOPE VI is a federally funded program started in 1992 aimed at improving distressed public housing and reversing the negative perceptions of it.) One of these projects in Seattle was recently evaluated for energy efficiency—and the results were encouraging.

The Seattle Housing Authority (SHA) compared energy use at three sites: 1) Yesler Terrace, a 69 year old project, a “base case” considered representative of much public housing in the country; 2) New Holly, constructed in the 1940s and substantially rebuilt in the 1990s, which reflects typical buildings built to existing code requirements; and 3) High Point a HOPE VI project, also originally built in the 1940s representing the state of the art for green building.

At High Point, SHA had made additional investments in energy efficient buildings as part of the HOPE VI improvements, so the agency wanted to find out if it would save a substantial amount of money.

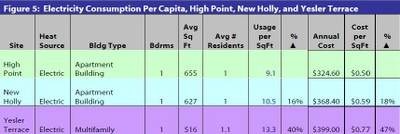

Check out the differences in electricity consumption:

The savings in water use were also significant.

The study found that Yesler Terrace residents, the ones living in standard public housing…

cost the Housing Authority a full $25.93 per person per month for water/sewer service, $7.45 per month more than per capita consumption at High Point, $89.40 more per person per year.

So High Point residents, where SHA had invested in green building standards, were costing the housing authority almost $90 less per person per year. When the project is fully sold it will have 1700 residents, so that’s a potential savings of more than $150,000 per year! And residents save too. Residents of a1175 square foot unit saved $235 on utilities in a year compared with residents in similar units at New Holly.

Is the savings sufficient to warrant the initial investment and possibly pay back bonds? It’s hard to say, in part because it’s hard to know what an acceptable “payback period” is. But the SHA study at least provides a starting point and some good numbers for affordable housing developers who are wondering if green building will result in long term savings for them and their residents. It’s clear that green building reduces energy use and attendant greenhouse gas emissions, but can it pay for itself too?

japhet

Almost all real estate is financed over 15-30 years. If you finance efficiency improvements over the same term, then what you are talking about is positive cash flow. Now ask, how much positive cash flow do we want to provide in public housing?

Anna Markee

Thanks Roger,Positive cash flow is very important in subsidized buildings because it means non-profit owners can maintain reserves needed to maintain the buildings over time. Down the road, these buildings need new roofs and siding like any other home. Low income housing buildings can’t simply increase the rent like a private apartment building. They are restricted to keep the apartments affordable for at least 50 years if not forever. So, any cost savings from increased efficiency means the housing authority or non-profit can do a better job of maintaining the investment over the long term.