[Update, 1/28/09: Go read this post instead. The charts below are outdated now and have been updated to include final energy price data for 2008. Read all about it here.]

***

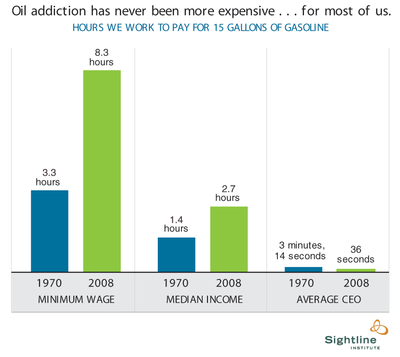

Americans are falling behind—most of us anyway. We’re working longer than ever before to maintain a standard of living that once we took for granted. With respect to gas prices, average Americans are much worse off than they were in 1970.

The working poor, in particular, are getting absolutely crushed. Their economic standing has deteriorated even faster than the middle class. A full day’s work at the federal minimum wage won’t even pay for a single tank of gas. In a car-dependent nation, that means that even basic transportation is quickly getting out of reach for low-income families.

Interestingly, the pain is being felt way up the income ladder. In fact, you’d see the same kind of trends for virtually every income strata if I had plotted their purchasing power here (though the effect is less pronounced the higher you go). But there is one big exception to the falling behind story: the super-rich. Nowadays, I suppose they should probably be known as the super-ultra-uber-rich. But whatever you call them, they’re doing great!

So that’s a relief.

The kind of figures that are kicked around in the income stratosphere are so mind-boggling that they’re almost beyond the comprehension of us ordinary schmoes. Forty years ago a CEO might make 60 times the minimum wage—a huge gulf that’s comparable to the spread in other wealthy nations—but nowadays a CEO might pull down 800 or 1,000 times the minimum wage. So despite skyrocketing prices for fuel and other basic commodities, the very rich are increasingly insulated from the real economy.

But what can we do about it? First, we need to understand the cause.

The explanation for Americans working harder than ever to pay for fuel is twofold. First, energy prices are through the roof—we’ve all seen the headlines this year, and the rise in prices at the pump compared to a few years back. But second, because middle class incomes have stagnated to an alarming degree. That second factor, however, almost never makes the headlines. That’s a shame because middle class Gen-Xers are watching the lifestyle they grew up with—the average Baby Boomer purchasing power—recede over the horizon.

For median income-earners—the middle class, by definition — things have been getting pretty gloomy lately. In fact, if gas prices are any indication, we’re worse now than we were even during the worst days of the energy crisis. See this chart:

In light of the recent economic meltdown, it’s pretty clear that we need some serious changes to the economy—and in particular we need aid for low- and median-income folks. After all, we have some control of our incomes and income equality.

On the other side of the equation there’s our energy spending. We have very little control over highly volatile oil prices, which are determined by world markets and (sometimes) by speculators. But we do have control over how much oil we use. To date, we’ve organized our economy so that we use a lot—and oil has paid us back by repeatedly whiplashing our economy when prices spike.

So it would seem to make economic sense then that we begin unhitching our economy from oil. That means more drilling isn’t just futile, it’s actively counterproductive. It’s like trying to cure an addiction by looking for one last fix.

In the long run, limiting our use of fossil fuels—as with a legal cap on climate-warming emissions — isn’t just a climate strategy to protect polar bears. It’s a bread-and-butter economic strategy to help the middle class.

It’s hard to know where things will go from here. On the upside, oil prices have dropped precipitously on fears of big demand reductions owing to an economic meltdown. On the downside, well, er, economic meltdown. It will be cold comfort to middle class workers facing unemployment that they won’t need to commute, and they won’t be able to afford even a road-trip vacation.

Notes: Gasoline price data from the US Energy Information Administration, here; gas prices include taxes. Minimum wages from US Department of Labor, here. Average income from the US Census Bureau, here. Average income refers to the median annual earnings for fulltime year-round workers. I combined earnings for men and women by using a weighted average for each year. Median earnings in 2008 are estimated at roughly 103 percent of 2007 income (which is the average annual rate of increase in nominal earnings over the previous 5 years). Annual wages are converted to hourly wages by dividing annual earnings into 2080 hours of work, a standard definition of fulltime work. Average CEO pay in 1970 is estimated at 62 times the pay of a minimum wage worker based on this analysis by the Economic Policy Institute. Average CEO pay in 2008 is conservatively estimated at 821 times the pay of a minimum wage worker based on the same EPI source but using the 2005 ratio. A big thanks to Laurie Kellogg who designed these charts.

Samuel

1970 was just before OPEC really started screwing us over. There’s more to this story than merely changing incomes. Although it seems like gasoline would be a great indicator of real wage changes over the years, it’s not in this case. You’d be better off comparing 1980 to 2008 instead. Or you could use a different commodity and keep 1970 and 2008. Or you could use a more useful indicator like CPI, which would be far more encompassing and meaningful. Or you could simply look at real wages between 1970 and 2008 in 2008 dollars, which would be best. That way you could compare those numbers to CPI stats for the two years and actually make a worthwhile statement.