Poorly regulated real-estate lending wasn’t the only cause of the economic meltdown now gripping the industrial economies. Oil addiction also contributed.

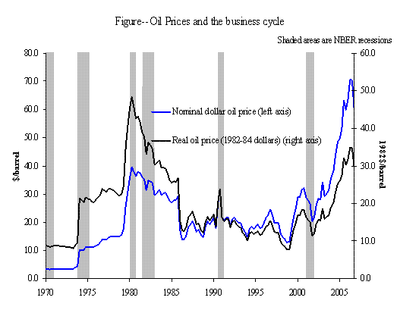

The extraordinary rise in oil prices since 2003 has sucked hundreds of billions of dollars out of the US economy (and the Cascadian economy). High oil prices have been a contributing cause of most recessions: Since 1948, “all large oil price increases but two have been followed by recessions,” as Andrew Hoerner and Nia Robinson of Redefining Progress (RP) write (pdf). “Four of the five recessions since 1970 . . . were preceded by big jumps in oil prices.” The figure above, from the Reserve Bank of St. Louis (hat tip to RP), illustrates the point. Shaded gray bars show the recessions officially declared by the National Bureau of Economic Research. The black and blue lines show the price of oil in inflation-adjusted “real” terms and in unadjusted “nominal” terms.

What’s more, the oil price surges of the recent past helped to trigger the wave of defaults and foreclosures that revealed the overextension of US mortgage lending. High energy prices have severely strained family budgets—especially low- and moderate-income family budgets. Some of those families couldn’t afford to keep paying their mortgages and also buy gasoline.

In short, if we weren’t so addicted to oil, we would not be so vulnerable to price shocks. This fact underlines the importance of seizing the opportunity of the financial meltdown and its resulting economic downturn to break the addiction.

Dave

Thank you for posting this article, oil prices are truly the 800 lb. gorilla in the room. Since the stock market meltdown began, I’ve been dismayed at the lack of attention being paid to oil prices as the catalyst for the economic downturn. It’s so convenient to point the finger at lax regulations of mortgage-backed securities, excessively depressed interest rates, and inadequate risk analysis by banks—all certainly deserving of attention in their own right—but oil prices are still framed as a microeconomic and not a macroeconomic issue.What a tremendous opportunity to reframe the perils of our oil addiction, I couldn’t agree more.

Barry

A great post Alan! While it is true the opaque risk of wall street investments are the “boulder” crashing though the economy…the shove clearly came from oil prices.Of course our fossil fuel addiction is also shoving another much bigger “boulder”…the climate feedback loops. As the saying goes, our carbon emissions are the fuse, methane feedback is the bomb. Again the problem is the opaque risk in billions of economic transactions. In this case the hidden risk is to climate stability. There is a reason Lord Stern in UK called climate chaos the “greatest market failure in history” in his official report. In this meltdown, which has already started, we don’t have central carbon banks to use to re-balance the carbon flows. Will we use the lessons of the monetary crisis to eliminate these more dangerous hidden risks? Will we make the costs more transparent through true carbon pricing? Or will we retreat to fetal position?

Wayne

If economic recessions are caused by (or at least associated with) high oil prices, as implied by the chart, a case can be made that recovery from those recessions and a return to prosperity is caused by (or associated with) the oil price receding back to low levels. This certainly seems to be the case in the price spikes in the 1970’s, which eased in the 80’s and collapsed in 1986 leading to a revival of the world’s industrial engines (and unfortunately also back to wasteful ways) and a return to economic growth through the 90’s.The question now is: will this happen again? The price 1970’s spikes were caused by planned cutbacks by OPEC, primarily Saudi Arabia, of their immense production capacity. OPEC was basically flexing their newly attained muscle as the world’s swing producer, which was handed to them by the USA as we reached our peak of oil production in the early 1970’s. Prices retreated in the 1980’s as OPEC learned some lessons but also because supply from newly found and developed North Sea, Prudhoe Bay, Mexican and other non-OPEC fields came on line. The trend of global oil production peaked at about 65 million barrels per day (MBOPD) in 1979, then actually decreased for a few years, and resumed its upward climb to about 85 MBOPD today.I think the oil price rise over the past few years is fundamentally different than that of the 1970’s in ways which do not bode well for a long-term retreat to lower price levels. One difference is that the price rise since 2002 was not caused by the planned shutting-in of existing production. World -wide production has been essentially full blast with only the Saudi’s claiming any excess capacity and that only a relatively small amount. Another difference, and more important, is that the large new fields that came on-line in the 1980’s are all producing their last oil in much smaller volumes than at their peak, and there are not enough new large fields to replace them. It is unlikely that global oil production will ever greatly exceed 85-90 MBOPD. This geologic limit on supply (known as “peak oil”) was, I believe, the prime driver of the price rise as participants in the oil market gradually were convinced of its reality. In this view, speculation in the oil market was not the chief culprit in the rise although it probably played a part in pushing prices far past any equilibrium point of supply and demand.This latest episode of price increase that ended this summer has likely brought on a recession that we are now facing. Will it play out by reducing demand and cutting prices? It looks like its going in that direction. How far will prices fall? Back to dollar equivalent values on the 1980’s? If the world has reached a peak in oil production, it is hardly reasonable to expect a return to low oil prices except during recessions when demand is greatly reduced. And if the price of oil remains elevated we can’t expect the normal wheels of industry, the traditional means of economic growth that rely on cheap energy, to pull us back to prosperity. Then, in your words, “the importance of seizing the opportunity” presented by the situation was are in becomes all the more urgent. We should be using our talent and energy to form a new economic models that accommodates higher energy costs and, as suggested by your post of 10/8 “living within our means”, to look at different ways of living.I could to on, but will leave it to future posting and discussion.