Like everyone else watching the stock market, I’m having that scary weightless feeling. It’s the same feeling I had when, as a kid, I took a dare to jump off a 55-foot cliff into Lake Chelan. Uh-oh, it’s a long way down.

If there was ever a day to watch the market, it was today. (And tomorrow too, probably). But something always grates on me. We obsess over the volatilities of the stock market while essentially ignoring the basics of the “real” economy—the one that people live in.

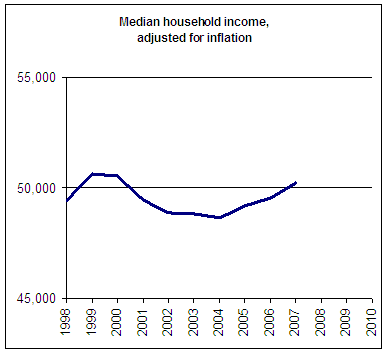

What are arguably the most important economic indicators are almost always overlooked. Here’s a look at US median income. It’s probably the single best indicator of the health of the American middle class.

As you can see, things haven’t changed much since 1998. Sometime during the mid- or late-90s, the middle class hit a permanent plateau. To be sure, total wealth skyrocketed during this period. GDP went gangbusters. But all that new money managed to bypass the middle class.

And here’s a look at the US poverty rate.

It’s a similar story.

Despite a decade of economic progress, American poverty has endured.

As we head into uncertain economic times, it will be interesting to see if anyone starts paying attention to these kinds of indicators—the indicators of the economy where people actually live, pay bills, and try to get by.

morgan

I’m not too optimistic that these kinds of policy drivers will change. The poor hardly vote while the wealthy vote a lot AND fund campaigns & lobbyists.It could be pretty interesting to display the 5 quintiles, the top 10 & 1 percent, GDP & the stock market to show how upside down policy outcomes have been. Even showing net-savings for all but the top decile would be revealing.Either way, I’ll be watching too.

Matt the Engineer

I have an uneasy feeling that volatility benefits the rich. Someone has this market figured out, and it sure isn’t the middle class or their representatives (if they have any left).