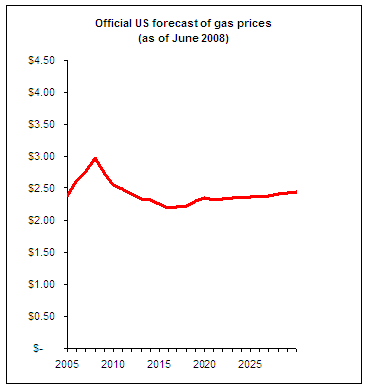

My patience is wearing thin. Yesterday, to some fanfare, the EIA released a bullish forecast predicting big demand for fossil fuels. Something seemed fishy, but I couldn’t put my finger on it until I saw the brand-new—just revised—projections of future gasoline prices:

No, honestly, this is the US government’s official projection—aka “the reference case” — for gasoline prices, shown here in 2006 dollars. In fact, it’s so official that it comes under this banner: “The tables presented here summarizes [sic] the revised early release version of the AEO2008 reference case and replaces the early release version that was initially posted in December 2007.”

But as anyone not living under a rock is aware, the average retail price of gasoline is currently above $4 per gallon (it’s $4.13 nationally, to be precise). This leads me to one of two conclusions. Either a) the poor researchers at the Department of Energy actually do live under a rock; or b) the EIA is doing what can only be described as “a heckuva job.”

With price forecasts like this, it’s no surprise that the EIA is expecting big future fossil fuel demand. With gas so cheap, why not keep guzzling?

Am I being too snarky? Maybe. In fairness, the EIA also publishes a “high price” forecast, just in case something untoward should happen (see page 11 of this pdf). Boy, I sure hope that high price forecast doesn’t materialize because it shows future gas prices getting up almost, but not quite, to $4 a gallon by… wait for it… sometime around 2030.

badda-boom

Now, far be it from me to challenge a team of energy experts, but it’s not like this is the first time the EIA has made a mistake like this. In fact, they make it pretty much every month, as I’ve documented here. And then they sum up their monthly mistakes into big annual mistakes, as I’ve shown here.

Sure, predicting future energy prices is a tough business. There are thousands of variables and the markets are volatile and unpredictable. Plus, the US government energy experts are at a big disadvantage to me — because I have a time machine. In fact, Future Eric just sent a message to me from later this afternoon: it turns out that a gallon of gasoline already costs more than $4. He found out by checking the EIA’s website.

***

Update 12/26: Apparently, this problem isn’t confined to the US. Just yesterday, British Columbia released its new “climate action plan,” which earned an interesting editorial from the Vancouver Sun:

…the numerical modelling that concludes the plan as presented will achieve 73 per cent of the reductions needed to meet the 2020 goal should be read as an educated guess.

As if to illustrate the point about the range of uncertainties, the price used in the “high energy cost” scenario for a barrel of oil in 2020 is $85. On the day the report was issued, the price was closing on $140 a barrel and some credible observers are predicting it will top $200 before long.

The editorial doesn’t point this out, but there’s actually a weird silver lining here. Higher than expected fuel prices mean that the program can be accomplished more cheaply than the estimates indicate. That’s because the consumption of fuel-based carbon falls faster than the model expects.

CharlieW

Seems it’s been years since the EIA’s forecasts had any credibility at all. The more time you spend rummaaging among their forecasts, the more convinced you become that their analysts ARE under a rock, and aren’t allowed out. Ever. It’s pathetic. Our tax dollars at work? Comic books come closer to reality. I would REALLY like to understand how it happens, year after year, that folks who pay even a little attention puzzle over what those EIA analysts are smoking. There must be a story there somewhere…

YoureStupid

Hmmm, looks like you are the stupid one now… the $4 you saw was a simple blip due to speculators (like the dot com bubble). Gas will continue to be available at the $2 range +/- for quite a long time. That said, we should reduce our dependence on oil just to F all those terrorist in the Middle East (including Israel… leave them to fight their own battles… they got themselves in this mess, let them get themselves out).

Eric de Place

Well, it certainly wouldn’t be the first time I was wrong. But only time will tell if the canny forecasters at EIA nailed it. Maybe it was by anticipating a gigantic global financial and economic meltdown that almost no one else saw coming? Oh, no, I guess they didn’t do that. While we’re on the topic, I think it’s more than a little interesting that the International Energy Agency—a far more credible source—is predicting oil at $200/barrel in 2030 (that’s denominated in today’s dollars). And last I checked, the futures market—the folks who actually have some skin in the game—don’t agree with EIA either. But we’ll see.

Michael

The EIA forecast brings up an interesting question. Can the politicians in Washington DC be relied upon to do any long range planning? I’ve noticed the quick band aid approach to planning like the graph that you have above. What’s going to make the politicians look good in two years when they begin the two year campaign to maintain their personal grip on power. We all know how important it is that Joe Dumas gets re-elected for Town Council, yes there is actually a guy in my town with that name running for Town Council. Would politicians do more long range planning if they were limited to One Term and required to wait a reasonable amount of time before running for any public office? The Obama administration appears to have the best plans at this time, at some point I’d like to see this country address the Term Limit issue. I’d be interested in hearing why we should not have a term limit of 1?

I’ve heard estimates of fuel prices reaching $18 per gallon by 2029. With a global population that grows exponentially should we expect fuel prices to also increase exponentially. Many of the older economic models were off because the average per capita income in China hit levels about 20 years before many economic models had forecast. Do we have a backup plan? Should we expect one? How about a Hydrogen Super Grid with refueling stations along the way? The automobile mfg. companies already have hydrogen powered vehicles, just not many places to fill them up. Building a Hydrogen Super Grid could create some great jobs right here at home instead of ANWAR. Why are the electric utility companies in the U.S. not jumping on a chance to get some of the oil and gas revenue? Seems like a no-brainer to me.