When it comes to condominium development, Cascadia’s two largest cities couldn’t be more different. Last year nearly 60 percent of new housing starts in the city of Vancouver, BC, were condominiums; meanwhile, Seattle saw no new condominium buildings open. And that’s not changing anytime soon: less than 10 percent of all building slated for downtown Seattle in the next three years will be condos. What’s the difference—why the blossoming of condominium construction in one city and the almost complete dearth in the other?

The short answer is economics. In Vancouver, apartments are saddled with an unfavorable tax code, making condos the more lucrative multi-family housing investment even despite high rental demand. In Seattle’s skyrocketing rental market, one that’s climbed even faster than the condo market in recent years, apartment buildings are much more financially attractive, while condos come with bigger risks and, typically, lower returns. Compounding this profit difference is the fact that Seattle condominiums have to comply with quality assurance standards more demanding than those for any other type of home in Washington. As a result, condo projects require additional insurance coverage, which makes development more expensive. It’s unclear how much this additional insurance adds to project pricing, and how much of Seattle’s slow condo market is simply due to the competitiveness of apartments.

More condominium development could be a good thing for prospective homebuyers in Seattle as condos are cheaper than single-family houses, which currently dominate the options for home ownership. On average, Seattle condos are worth two-thirds as much as typical single-family homes. Though condos are often smaller, and have fewer bedrooms, than single-family homes, and therefore are not always well-suited to families with children, they could be a particularly good ownership opportunity for first-time buyers including single people and couples without children and for retirees looking to downsize from houses.

As Seattle’s single-family housing market heats up (and up and up and up), condominiums are becoming more attractive investments for developers. Though not much condo development is slated for Jet City through 2019, more could begin quickly, and Seattleites may look forward to this additional housing choice blossoming soon.

In this article I’ll compare the condo markets in Seattle and Vancouver, BC, looking at how recent condo construction compares, and who the condo market serves in each city. Then I’ll look at the economic and policy factors driving each market. In Vancouver several tax code changes in the early 1970s served to make apartments a less attractive investment option and helped to spur the condo market. In Seattle the strong apartment market coupled with the additional construction liability on condos has disincentivized condo development. Finally I’ll review some state law changes that could help stimulate more condo construction in the Seattle region with the aim of opening this housing option to Seattleites interested in homeownership.

Seattle lags while Vancouver booms

Condo demand in Seattle is rampant yet supply is miniscule. The one condo complex actively in the city’s pipeline, the Nexus building, won’t open until 2019. Yet over 75 percent of its units sold out in just two weeks—most in just one rainy weekend—a full two years before anyone will even move in. Despite the high demand, condo construction in the city is sluggish, to say the least. Including the 374 units in the Nexus tower, Seattle will see only about 500 condominiums come on the market in the next two years (this fall Gridiron Condominiums will open, adding 107 units to Seattle’s condo supply). Besides those two projects, Seattle won’t see any other condos open until at least 2020 (a few other projects are in the works, such as the 32-unit Hendon Condominiums, but with no firm dates most won’t likely open in the near future).

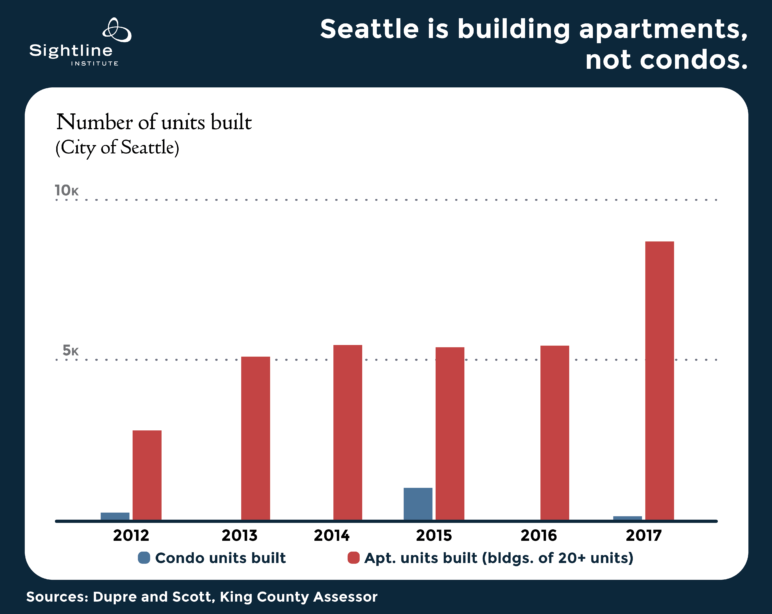

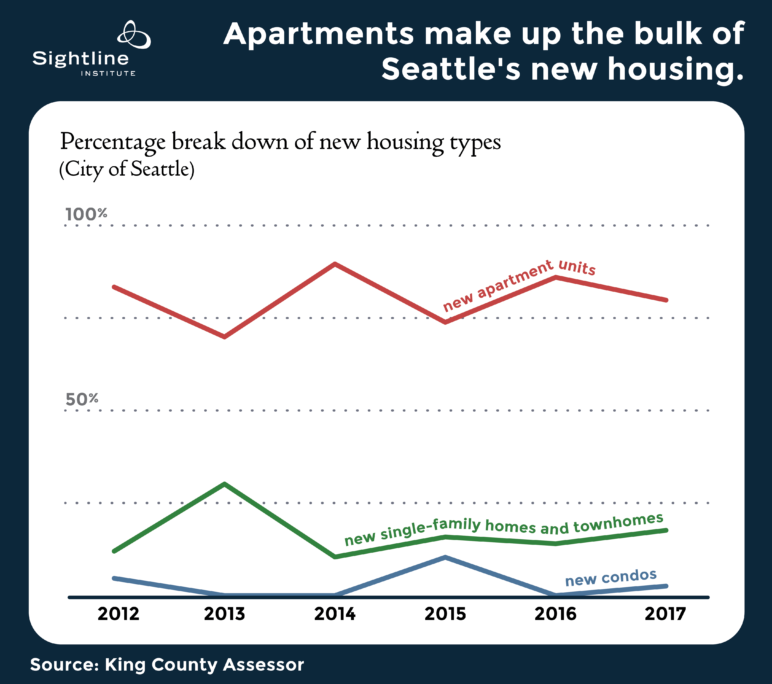

Instead of condos, builders are putting up apartments. Less than 4 percent of all new residential units built in the city of Seattle over the last five years have been condos while over 80 percent have been apartments. The remaining units have been split between single-family homes and townhomes. In the bar chart below, apartment construction, shown in red, dwarfs new condo construction, shown in blue.

Looking at all new building in Seattle over the last five years shows something similar: apartment construction has made up the vast majority of new units built in the city of Seattle. Meanwhile, single-family and townhome construction has hovered around 10 percent of new housing units built each year, and condominiums come in even lower than single-family homes, with several years seeing no new condo construction in the city. Building in the last five years is reflective of the city’s overall housing spread in which 46 percent of all housing units are single-family homes while just 7 percent are condos (ACS 2015 5-year estimates).

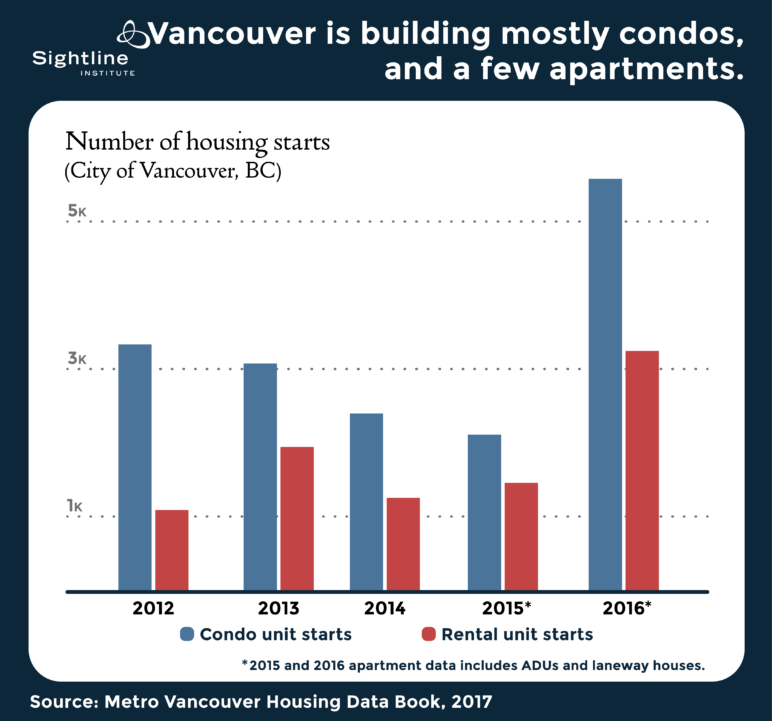

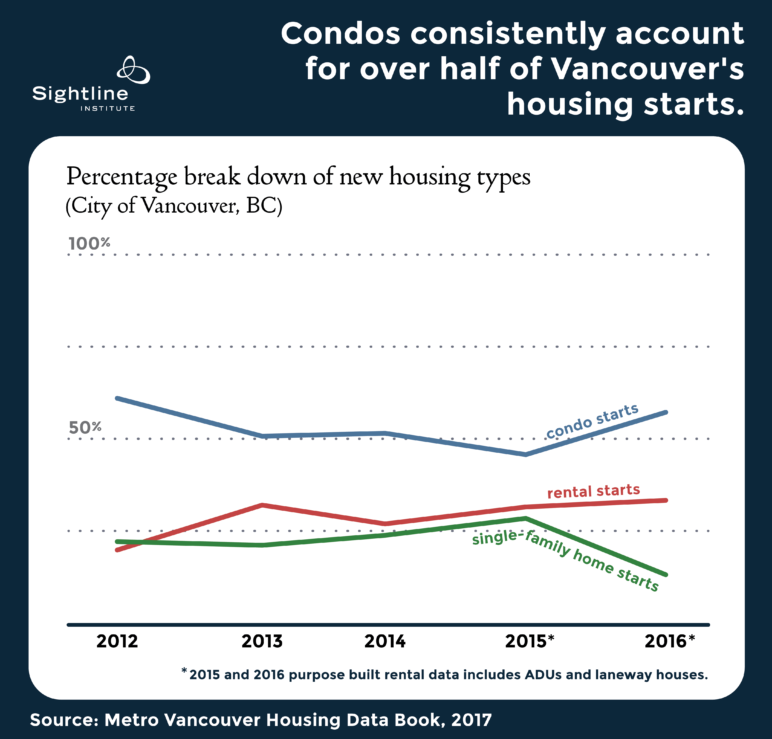

Meanwhile north of the border, things couldn’t be more different. In the city of Vancouver, rental units accounted for less than a quarter of housing starts between 2012 and 2016, while condos represented over half of the city’s housing starts; other ownership options such as townhomes and single-family homes made up the remainder of the housing starts. This year alone 11,000 new condo and townhouse units will hit the greater Vancouver pre-sale market. The trend builds on a longer regional history of high condominium production. Between 1996 and 2006, condominiums accounted for a full half of the increase in owner-occupied dwellings in greater Vancouver, a pace outstripping any other Canadian metropolitan area. By 2011, one-third of households lived in condos.

In the bar chart below, the blue bars (new condo units started in the city of Vancouver each year) tower above the red apartment bars. In the second chart the green line shows that condos have consistently made up more than half of the new housing starts in the city of Vancouver over the last five years. Though the difference between condos and apartments isn’t as dramatic as in Seattle, condominiums still make up the majority of new housing units started each year, while rental units and single-family homes together account for the remaining 40 to 50 percent of new housing each year. Similar to Seattle, the trend of the last five years reflects the city’s overall housing makeup well: in Vancouver overall condos comprise 41 percent of total housing units while purpose built units making up just one-fifth.

Who buys condos?

Condominiums in the United States typically appeal to buyers at two ends of the housing spectrum: first time home buyers, and seniors looking to downsize for health or family reasons.

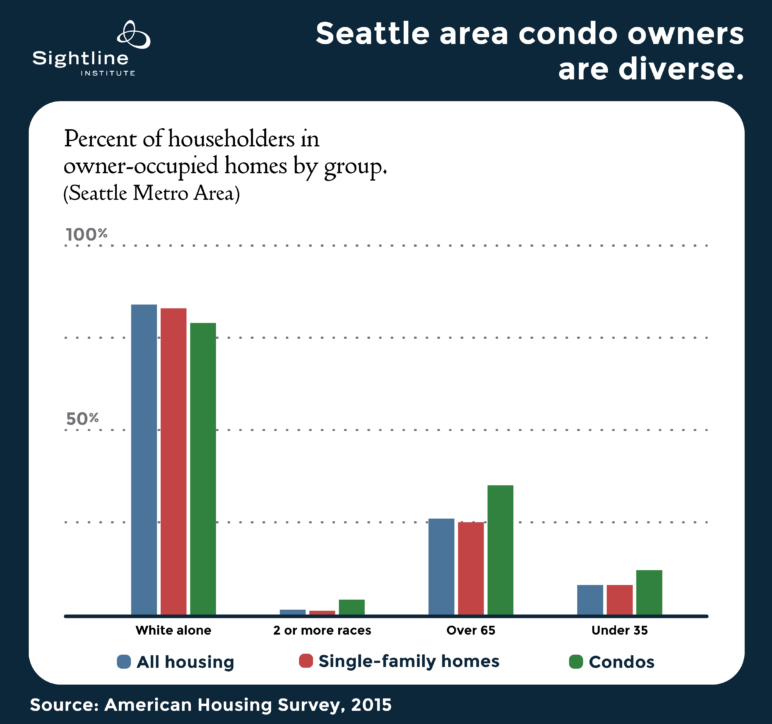

Seattle’s condominium buyers are largely of the latter sort. In 2015, about one-third of condos in the metropolitan Seattle area were rented out. But of the remainder, the owner-occupied ones, more than two-thirds were home to people aged 65 or older. In comparison, this age bracket owned one-quarter of all housing units in the area. Young people in Seattle rely on condos for ownership opportunities to a somewhat lesser extent. In 2015, 12 percent of householders in owner-occupied condos were under 35, compared to just 8 percent of householders in all owner-occupied homes in the area.

Condos also house a somewhat greater racial and ethnic diversity of homeowners in the Seattle metro area than other owned home types. Whereas 84 percent of all householders living in owner-occupied homes in 2015 reported “white” as their sole race, some 79 percent of owner householders in condos did so. Four percent of owner-occupied condos housed people who reported being two or more races, as opposed to just 1 percent of all householders in owner-occupied homes.

Condominiums are cheaper than single-family homes

Condominiums are a cheaper homeownership option for homebuyers in both Seattle and Vancouver. In the city of Vancouver, most condominiums were between one-fifth and one-third the price of typical single-family homes in April 2017. Though in Seattle condos are also less expensive than the typical single-family home, the difference is smaller than in Vancouver. Last year in Seattle, the average condominium value was equivalent to two-thirds the price of the typical single-family home. The fact that condo values are closer to the value of single-family homes in Seattle is likely due to the fact that Seattle has so few (as stated above, they make up just seven percent of the city’s total housing stock). Those it does have skew toward one type—luxury units—while Vancouver condos have a broader variety of types and price points. Condominium value in Seattle also appears to be increasing slightly faster than the value of the city’s typical single-family home. As of May 2017, estimated average condo value was 68 percent of the estimated average single-family home value in Seattle.

While condo sales are climbing closer to the average single-family home selling price in Seattle, they still remain cheaper, on average, than single-family homes. Thus, they open homeownership to a segment of homebuyers who may be priced out of the single-family market in either Seattle or Vancouver.

[list_signup_button button_text=”Like what you|apos;re reading? Get our latest housing research right to your inbox.” form_title=”Housing Shortage Solutions” selected_lists='{“Housing Shortage Solutions”:”Housing Shortage Solutions”}’ align=”center”]

What’s fueling condo development in Vancouver?

Vancouver’s housing market is red hot, and the condo market is no exception. But why the preponderance of condos over apartments in new construction, especially with the high demand for more rental options in the city? One reason may be that builders have experience with condos in the region; they are left with little doubt that condos will sell and sell well. Similarly, condos may be more of a cultural norm for many Vancouverites than Seattleites (indeed, the trend toward condos is country-wide, though Vancouver leads the Canadian pack). But in addition, builders may have a disincentive to invest in rental properties. A series of changes to the Canadian income tax code in the early 1970s and 1990s made rental housing a poor choice for investors.

One impactful change was taxing capital gains on rental properties at the time of sale. Previously, investors had been allowed to defer capital gains taxes when the sale proceeds were quickly reinvested in another rental property. This deferment of capital gains tax is still permitted in the US tax code.

Another major disincentive to apartment investment was the removal of a tax shelter provision in rental development. Though it’s common to think of tax shelters as loopholes that help wealthy individuals keep their wealth and get richer, they can also direct what types of investment happen. Prior to 1972 investors could claim high depreciation on rental properties, which lowered their taxable income from other sources. In 1972 the allowable depreciation was cut in half and since then has been lowered further. Often this type of subsidy is necessary to make rental properties an attractive investment, as they have high startup costs and low revenues at first. When this tax shelter was eliminated in the early 1970s many investors calculated that the high startup cost for apartments was no longer worthwhile.

Other tax code changes have also depressed the rental property construction market: in 1972 most small rental businesses no longer qualified for the lower tax rates of other small businesses; in 1991 the Canadian government applied the goods and services (GST) tax to rental construction increasing the new construction tax rate by nearly 70 percent.

Not surprisingly, these additional tax burdens on rental property not only deter new construction in the rental market but also increase rent for tenants. Canadian tax code for rental properties may add as much as $200 per month to rents on properties in most of Canada’s major cities. Over 25 years that amounts to $60,000 in additional fees for a tenant.

What’s stopping Seattle condo development?

Two major factors contribute to the depression of condominium construction in Seattle. The first is the city’s skyrocketing rental market—as rents continue their upward climb in the city, one that’s been far steeper than the rise in condo value, apartment construction remains a more attractive investment than condominiums. What’s more, rental properties don’t face the same tax burdens in Washington that they do in British Columbia, so there’s no disincentive for investors to go big into the rental market. In addition to, and compounding the apartment market advantages, the condominium market appears risky to homebuilders and their insurers due to the exacting, and sometimes ambiguous, standards of the Washington Condominium Act. This perception of risk, and attendant expenses of the required additional insurance, may be the tipping point which turns many potential condo builders toward the rental market.

Seattle’s rental market is surging

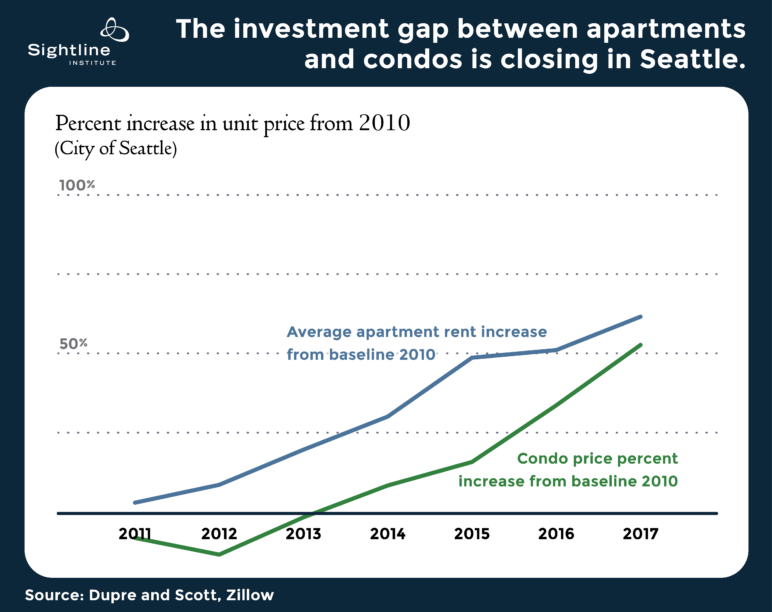

The skyrocketing Seattle rent market is likely the primary reason that developers have built so few condos in Seattle in recent years. With major profits to be made in the rental market, condominiums aren’t at the top of builders’ minds. Between 2010 and 2017, apartment rent in buildings with 20 or more units rose 62 percent while condo values only climbed 53 percent. As a result, builders have planned more apartment buildings and shied away from condominiums. And that gap is much smaller today than it was a few years ago. As the chart below shows, things looked even bleaker for condos in 2014: between 2010 and 2014 apartment rent rose 30 percent while condo value only went up 8 percent. Most developers looking at those numbers in 2014 wouldn’t have given condos a second thought; the buildings growing into the Seattle skyline trail a few years behind builders’ decisions, so the building Seattle is seeing today reflects those numbers of a few years ago. While growth in condo value is still trailing apartments, the gap is starting to narrow. This narrowing gap may indicate that Seattle is nearing a tipping point in which some condominiums begin to pencil as viable investments. Though this tipping point may be coming soon, it will take a few years for the supply to catch up.

Expensive insurance

The 1989 Washington Condominium Act (WCA) regulates condominium construction defect disputes in Washington and applies building quality standards more exacting than for any other home building in the state. The purpose of the WCA is to protect condo purchasers from developers trying to cut costs by using shoddy materials or construction methods. The WCA lays out an implied warranty of quality construction for condominiums, meaning that should condo owners find that their units have significant defects they can pursue compensation from the builders, either via repairs or monetary damages.While the purpose of the implied warranty is to protect buyers, many homebuilders have argued that its execution has been counterproductive. Because of the ambiguous coverage of the implied warranty, condominium builders weathered a slew of high ticket lawsuits in the late 1990s and early 2000s in which home owner associations (HOAs) successfully sued builders for building defects they may not have been held liable in a different home type. Many builders called these defects trivial breaches of building code and accused HOAs and lawyers of using the ambiguous law as a cash cow. This risk of lawsuit and the resulting need for additional insurance, builders claim, have been deterrents in further condominium development. At best, the spectre of lawsuit has made condo conversions a more attractive option: build apartments now and convert them to condos once the seven year statute of limitations has run its course.

While high insurance fees certainly add an additional expense to condo development in Seattle, it’s unclear that it is the main deterrent to condo construction. According to one calculation, the price of the additional insurance that condo developers purchase is equivalent to roughly one-half to one percent of construction costs. Regardless of how much risk of litigation is depressing the condo market, removing these barriers cannot hurt, and will only help, encourage more condo development in Seattle.

British Columbia’s Statutory Insurance Program: a model for reducing development risk

In one attempt to reduce builders’ perceived liability risk from condo development, Washington legislators added a non-mandatory warranty insurance program to the Washington Condominium Act in 2004 (a review of the bill is here). Lawmakers modeled the program on British Columbia’s mandatory insurance program, which requires all homebuilders to purchase warranty insurance with certain minimum requirements. Washington state’s spinoff of this program allows condo builders to purchase warranty insurance for every unit in a building, as well as for the HOA, which would give them immunity from liability should condo owners file claims for construction defects down the line. In other words, in a building with full warranty insurance, if a condo owner finds a defect in his or her unit or a common area, the recourse is to file a claim to the insurance company rather than sue the builder.

When the program first came online, there were high hopes that it would stimulate Seattle’s condo market. Yet the program does not appear to have had much effect on condo construction over the last decade. This may be due in part to the fact that the program’s non-mandatory nature has meant that insurers have not been eager to offer this insurance option. Secondly, the legislation does not preclude insurance companies from seeking payment from developers, meaning that even if developers do purchase warranty insurance for their projects they cannot rest assured that they are clear of any future liability.

Could other reforms boost Seattle’s condo development?

In addition to instituting the statutory insurance program, state legislators have made several other amendments to the WCA to reduce condo development risk and stimulate development (for a review of these amendments read this article). Despite these revisions the condo market remains slow. Four additional policy reforms may further reduce builders’ condo reticence and jumpstart condo development. These changes reduce the incentive for condo owners and HOAs to pursue costly litigation for perceived defects in cases where things could be resolved with repairs or mediation. Other states have limited these incentives through a variety of policies, and these cases present models Washington could emulate to lessen risk for developers, while still protecting condo purchasers’ rights. Though these policy adjustments may not in themselves hold the key to unlocking Seattle’s condominium market, they may reduce barriers and grease the tracks to encourage more construction of this housing type.

1. Cap attorney fees

The WCA allows judges to award attorney fees to the winning side, to be paid by the losing side. Though there is no cap on how much a home builder may have to pay in attorney fees, there is a cap on how much a homeowner or HOA may be liable for in the event of a settlement. Condo owners, in other words, have every incentive to sue and little incentive not to. That provision may have motivated plaintiffs’ attorneys to file excessive claims and run up legal fees with the expectation that they will later be paid by builders or their insurers. In fact, law suits over condominium defects have been so lucrative that some attorneys and firms began to specialize in this type of suit.

In Nevada, a state that has seen some huge battles between builders and homeowners, builders’ insurance fees have increased by as much as 400 percent since the state enacted its attorney-fee provision. In an attempt to combat this cycle Nevada passed a law in 2015 removing the award of attorneys’ fees from condo arbitration or litigation. Washington state lawmakers could follow suit. Alternatively, Washington legislators could enact a less extreme measure to similar effect, such as implementing a cap on the amount of attorney fees for which a homebuilder may be held liable.

2. Binding arbitration

In 2005 the Washington legislature added an alternative dispute resolution (ADR) procedure to the WCA by which condo owners and developers could resolve grievances through mediation or arbitration. Though mediation is mandatory, it’s nonbinding. Arbitration is optional for parties but also nonbinding, which is somewhat unusual. If homeowners are unhappy with the outcome of arbitration they are free to request a complete reconsideration of the arbitrator’s decision through a trial. This non-binding arbitration provides little protection for builders.

The legislature could introduce mandatory, binding arbitration. Alternatively, it could set a higher bar for homeowners to qualify for a trial after arbitration. California already took this step in the state’s Right to Repair Act, which places restrictions on forgoing—or disregarding—arbitration.

3. Right to repairs only

The WCA permits HOAs to require monetary damages for claimed defects, instead of repairs of specific defects. This policy encourages HOAs to file claims as they can apply money they receive from successful suits to building improvements unrelated to the alleged defects. To curtail abuse of the implied warranties, Washington could limit remedies to specific repairs and remove the opportunity for HOAs to collect monetary damages.

4. Government of HOAs

Finally, restructuring condominium associations may also make condominiums a more attractive development choice. Current state law mandates that the homeowners’ association board members make decisions for the care of the building on behalf of all members. Any board member who errs on the side of not sueing may be at risk of a lawsuit him- or herself—from other condo members. This incentive would shrink if all HOA members had to vote on decisions such as initiating litigation.

Conclusion

Condominiums fill a niche in the housing world, offering a homeownership choice well-suited to anyone who doesn’t want to tend a garden, mow a lawn, or fix a roof. Yet condo construction in Seattle is all but stalled, leaving a gap in the city’s housing options. The good news is that Seattle may start to see its condominium market pick up. As the single-family home market heats up, more prospective home buyers turn to condominiums and are willing to pay higher prices for them. This shift could turn condos into a stronger investment choice for developers. Policy changes to reduce builders’ risk may help this process move along, and broaden housing options for Seattleites.

In comparison, Vancouver’s condominium market couldn’t be hotter. Condos dominate new residential construction and may soon become as common as single-family homes. While Vancouver suffers from a similarly disproportionate coverage of single-family zoning as Seattle does, condominiums offer a more urban lifestyle, one that makes sense in a global and growing city. Seattle could follow in its northern Cascadian sister’s footsteps by embracing this housing option.

Thanks to David Leon for his review of Washington state condominium law in his 2016 report for the Runstad Center. Much of the review of condo law in this article was inspired by, and built upon, that report. Thanks also to Dan Zimberoff and Brian O’Connor for their insights into Seattle’s condominium market.

Methods

Apartment rent data and buildings cited in this article comes from Dupre and Scott, 2017 and are for apartments in buildings with 20 units or more. Condominium and single-family home price data from is taken from the Zillow home value index estimates as of May 2017. Condominium building data from King County Assessor and Metro Vancouver Housing Data Book, 2017.

To calculate the number of building units in Seattle each year we used King County Assessor data, combining data from the Apartment Complex, Condo Complex, and Residential Building datasets for all units built 2012-2017.

[button link='{“url”:”http://www.vancouverrealestatepodcast.com/vrep-83-vancouver-developers-need-tax-loopholes-margaret-morales/”,”title”:”Listen in: Margaret chats about her recent article on Vancouver Real Estate podcast. “}’]

Comments are closed.