Few public policy issues can match urban housing politics for its incendiary combination of passion and misconception. To wit: the confounding idea that relaxing regulations and fees to decrease the cost of homebuilding won’t make homes more affordable.

Why? Because, goes the refrain, developers charge as much as the “market will bear” anyway. Any savings from streamlined regulations or reduced fees just yield more profit for the developer, not lower prices or rents.

That reasoning may sound legitimate, but it’s bogus. It misses the forest for the trees—or, the city for the building. Across an entire metropolis, when homebuilding is cheaper, homebuilding speeds up. And in booming, housing-short cities such as Seattle, the more new homes built, the less prices rise—that is, the lower the price the market will bear.

Why does this misconception about costs matter? Because it excuses counter-productive housing policy.

Why does this misconception about costs matter? Because it excuses counterproductive housing policy. Why bother fixing ill-conceived regulations that boost the expense of homebuilding if you believe doing so won’t help affordability? If you believe it just puts more money in developers’ pockets?

What’s more, the confused logic also infects debate over adding costs: if the market sets prices with no regard for cost, it follows that policies that increase the expense of homebuilding can’t raise home prices. This rationale frees policymakers to ignore that imposing impact fees on new homes, for example, is likely to exacerbate their city’s affordable housing crisis.

It’s flawed thinking. It’s all too common. And it needs to stop if booming cities are to get housing prices under control. So let’s unpack it.

The real cost of red tape

Most people accept that if someone figures out a cheaper way to make a product, the price will drop. Producers make more, and the price the market will bear goes down.

A recent study conducted by the City of Portland, Oregon, estimated that on average, “government fees” add 13% of the total development cost of housing.

For housing, the rules that govern development often conflict with cheaper production. Drawn-out permitting processes and legal challenges add cost because time is money. Minimum apartment sizes effectively mandate more expensive apartments. Requirements that complicate building design—such as setting back top floor facades further from the street—raise the cost of construction. A recent study conducted by the City of Portland, Oregon, estimated that on average, “government fees” add 13 percent of the total development cost of housing.

For a real-world example, consider this story from Portland: in 2010 the city waived system development charges—typically ranging from $8,000 to $11,000—on accessory dwelling units (ADUs, otherwise known as mother-in-law apartments or backyard cottages). For most homeowners financing is the biggest hurdle to adding an ADU, and it’s not hard to imagine that the prospect of writing an extra $10,000 check just to get started would scare off many. Sure enough, after Portland removed the charge, ADU permit applications took off.

From pencil to project

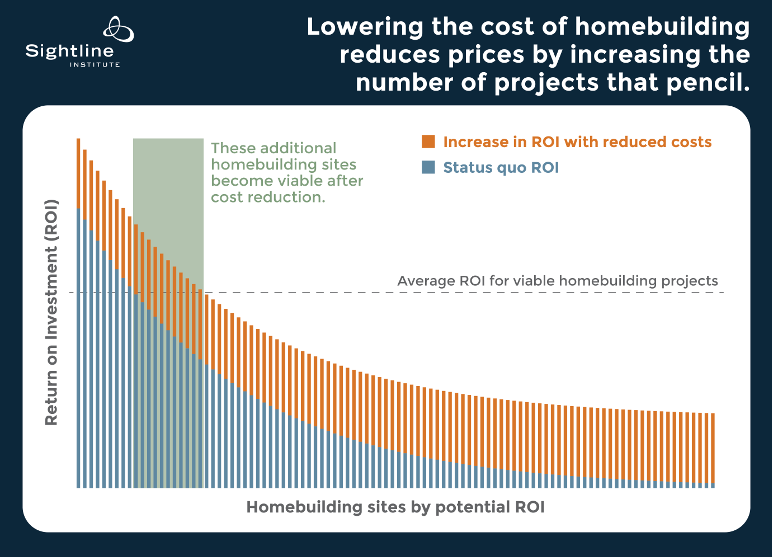

Developers build homes until the market becomes saturated and falling sale prices (or rents) no longer generate an adequate return on investment. However, if a city changes a rule or trims a fee and reduces costs, developers’ returns improve. Consequently, more homebuilding projects “pencil,” and more homebuilders get into the game. Less expensive homebuilding means more new homes get built and then sell for lower prices.

Original Sightline Institute graphic, available under our free use policy.

The diagram above illustrates the concept. Across a typical city, the potential return on investment (ROI) from homebuilding varies widely depending on site-specific conditions. Each blue bars represents one building site in an imaginary city, with the bar height indicating its potential status quo ROI. The orange bars show how a cost-cutting measure could increase ROI. (It’s an optical illusion that the orange bars are growing to the right—they are all the same length atop the blue bars). In practice there is no precise threshold ROI that makes all projects pencil, but for clarity the diagram depicts an average threshold ROI. Sites with ROI higher than the threshold pencil, and sites with ROI lower, don’t. As delineated by the shaded green area, decreasing the cost expands the number of sites where homes could likely be built.

Policymakers sometimes have reservations about altering regulations to cut costs, worrying that they are just handing windfalls to builders without helping affordability. In the larger picture, though, reducing the cost of homebuilding makes all housing throughout the city more affordable by shrinking the average price the market will bear.

Pause: this is not an argument to eliminate all housing regulations or fees. For example, most life-safety building codes are well justified. However, many other rules are not, especially given their tradeoff with affordability.

Trying to have it both ways

It may not be surprising that anti-housing activists resort to arguing that reduced costs don’t matter, but it is disappointing to hear similar thoughts from professional policymakers, who exhibit an oddly divided mind about it. On one hand, countless municipalities offer developer incentives intended to boost homebuilding. For example, the City of Seattle’s Housing Affordability and Livability Agenda includes numerous recommendations for cost cutting, ranging from design review improvements to building code updates for inexpensive wood construction.

On the other hand, urban planners and advocates across North America commonly contend that added costs don’t harm affordability, a prominent case in point being inclusionary zoning, which imposes costs on homebuilding by requiring private developers to provide below-market-rate homes.

In a recent interview with Vox, former Vancouver, BC, planning director Brent Toderian demonstrates the mindset in a discussion of mandates for family-sized units: “Economic analysis shows that two- and three-bedroom units can be less profitable than one-bedrooms or studios, but that’s not the same as saying that they aren’t viable.”

Here, Toderian glosses over a fundamental truth: “less profitable” prospective homebuilding projects are less likely to ever get built. Some fraction of projects may remain financially viable despite costly requirements, but another fraction will not. And the absence of this latter fraction from the city’s housing choices in the years ahead will increase competition throughout the housing market, raising prices. The figure above shows how this works.

Not to pick on Toderian—his views are commonplace among urban planners—but he recently provided another good example on Twitter in response to concerns that a new development fee would drive up prices: “Developers always claim that,” he wrote. “Still not true. Fees push down land value or profit from contingencies. Homes sell for what market will pay.”

User Suburbanist tweeted back, “But fees change market conditions. Buyers bid prices up when fees lower supply.”

To which Toderian responded, “Show me where fees lower supply.”

Unfortunately it’s impossible to do a controlled experiment on two otherwise identical real cities to prove that fees on homebuilding lower the supply of new homes. So the question to ask is: why wouldn’t they?

No land sale means no new housing. And no new housing means greater upward pressure on prices.

The standard retort is that added fees depress land values, so landowners, not homebuilders, take the financial hit. But as I have argued in detail previously, that claim doesn’t withstand scrutiny. It ignores the fact that most urban property already generates revenue, and owners always have the choice to keep collecting rents until offered a price high enough to make it worth selling. No land sale means no new housing. And no new housing means greater upward pressure on prices. There’s no wiggling out of it: affordability still suffers when fees depress land prices.

There is nothing magical about housing that insulates its market price from changes in its cost of production. Land values do complicate housing economics in some ways, but they do not break the universal economic supply chain that links cost of production, quantity of production, and price.

Furthermore, there is no magic number below which cost-inducing regulations and fees have zero impact on prices. The gain is proportional to the pain. Some policymakers may want to believe that a little added cost won’t do any harm. But that is a perilous line of thinking, because it gives the green light to adding more and more little costs here and there. They pile up in bureaucratic layers over time, ultimately causing death of homebuilding by 1,000 cuts.

Extending the bottom of the ladder

Affordable housing crises in expensive cities such as Seattle will never be completely solved by streamlining counterproductive regulations that add cost. Nor by trimming fees. Even with perfect rules, high land values and the raw cost of construction put new homes out of reach to people on the lower end of the income ladder.

But here’s the crux: the more costs can be cut, the further down on that ladder housing will reach. The lower the price of market-rate housing goes, the fewer households will need public subsidy to afford homes.

So, yes, red tape and fees do raise the price of housing—and cutting them lowers it.

Ben Schonberger

I think that the soak-the-greedy-developer crowd believes that every housing project is at the far left of your bar graph above. In those cases, yes, the builder will eat the cost and charge market rents. But that doesn’t change the fact increasing costs kill projects on the margin and the result is less housing and higher prices for everyone.

J, Tieger

“Pause: this is not an argument to eliminate all housing regulations or fees. For example, most life-safety building codes are well justified. However, many other rules are not, especially given their tradeoff with affordability.”

“Requirements that complicate building design—such as setting back top floor facades further from the street—raise the cost of construction.”

Yes, this increases the cost of construction but it gives the adjacent streets more light making them more psychologically comfortable and attracting more pedestrian traffic. Builders generally do not give a damn about livability or the community at large their interest stops at the bottom line and they not provide anything that benefits the long-term viability of a neighborhood unless required to do so. There is more to an appropriate building then the fire code (and they resist sprinkler systems too).

Dan Bertolet

I agree that urban design matters. I worked for ten years as a planning and urban design consultant at two Seattle architecture firms. My point is that the downside of the trade off is under appreciated.

In the example I linked, the setback requirement would likely add 1 to 2 percent to total construction cost, or about $600K to $1.2M. That’s equivalent the cost of 2 to perhaps 5 units in the building that could basically be given away for free to provide housing for low-income households.

I think we need to take a closer look at whether or not the benefits of urban design features—that are often highly subjective—justify their negative impacts on affordability.

Andrew Giraldi

“I think we need to take a closer look at whether or not the benefits of urban design features—that are often highly subjective—justify their negative impacts on affordability.”

Dan, regarding your comment about the need(?) for urban design features, I refer to research by the American Automobile Association (AAA), Chris Leinberger and Reid Ewing. In Leinberger’s book The Option of Urbanism, he describes two (fairly) distinct urban environs (drivable suburanism and walkable urbanism); the impact of car ownership and maintenance on household incomes; and the public health crisis that is obesity, which appears to be the result of rampant drivable urbanism. As Ewing points out in his book Transit- and Pedestrian-Oriented Design, the aforementioned environs are characterized by the degree which they adhere to nine urban design qualities and three checklists that rank the importance of certain urban design features in creating places that encourage active transportation (i.e. walkable urbanism).

As for the degree which housing is affordable from any presence of urban design features, I ask you to consider this: According to Leinberger, “owning an average car is the equivalent of having an additional $135,000 mortgage (mortgage interest is tax-deductible, and this calculation assumes six percent mortgage interest).” He appears to be referencing AAA’s finding that “the annual cost to own and operate a vehicle in the United States” was $7,800 in 2006. In 2016, AAA found that this statistic rose to $8,558, implying that ditching a car would result in a larger mortgage with all other nuances of Leinberger’s calculation being equal.

If families could be ditch a car knowing that where they lived wouldn’t result in any loss of the quality of life they want for themselves and their loved ones (e.g. the ability to be physically and mentally healthy), it stands to reason that they would apply any chunk of their incomes that might otherwise go towards car ownership and maintenance towards the premiums housing in walkable urban places (WalkUPs) tends to command. While WalkUPs seem to be highly regulated based on the attention given to their urban design, part of the cost premiums that they command is the result of their supply not keeping up with their demand.

Communities the result of attention towards sound urban design appears to be well worth any cost premium in their housing stock. The difficulty appears to be communicating the upside of these places from stringent urban design regulations to towns, citizens, and developers.

Dan Bertolet

Andrew,

Totally agree that walkable urbanism has huge value. The question is, who pays for what? I would argue that most of the important ingredients for walkable urbanism are rightfully provided by public sector — public open space, multimodal street design, and transit, for example.

As for buildings, the most important features they can incorporate to contribute to walkable urbansim are fairly simple: minimum residential density, no parking, built to the sidewalk, mixed-use, activated ground floor. These things add very little if anything to cost.

Where I see things start to go south is when jurisdictions try to regulate design features like upper level setbacks that don’t contribute much to walkable urbanism yet make new housing more expensive.

Steve Erickson

13% really doesn’t seem like much.

Shannon Carney

I helped write that City of Portland report that I believe you are citing. To be clear the 13% figure includes both review fees and system development charges, which help pay for the expansion of city infrastructure of course. I don’t disagree with the death to development by 1000 cuts (or more!), but I stand by our findings that construction delays due to slow permit/land use processing add more cost to development than review fees, esp for multifamily development.

Raal 1960

Great point Shannon. Developer fees and costs are generally knowable in advance, and a project won’t proceed unless they have taken those into account. But the time to get from concept to construction and sale is a huge unknown and drives developers to expect a much larger return on a project due to the uncertainty of when their product can get to market.

Dan Bertolet

Agreed, Raal. The tricky part is quantifying how much that uncertainty affects housing production and prices. Any suggestions you have would be appreciated!

Dan Bertolet

Hi Shannon! An article on the cost of entitlement delay is next on my to-do list.

Bruce MacGregor

Since the costs of regulations are easier to measure than the benefits (improved urban design, environmental protection, health/safety, etc), there is a tendency to ignore or minimize the benefits. Also, the costs are one-time costs while the benefits are long term. A major factor in housing cost is financing. Under the writers thesis, lower finance costs should lead to lower housing costs. Given the historic low cost of financing, housing costs should have declined. Has this happened? (Short answer: No)

spencerrecneps

The benefits to urban design are often highly subjective and often counterproductive. I’ve seen many ugly buildings completed that adhered to urban “design” standards. It’s a mixed bag at best in terms of qualitative outcomes.

Your financing example is specious. Lower financing costs wouldn’t necessarily result in lower housing prices, just prices that are lower than they would be with high financing costs. The impact has to be measuring in relation to the alternative. Unfortunately, we have no alternate reality to see what housing prices would be in the exact same city at the exact same point in time with higher financing costs. That’s even impossible to compare from city to city or region to region since finance markets are national in scope.

PSJ

Similar to J, Tieger and Bruce MacGregor, above, I believe that some of the regulations do yield benefits that are worth the costs. With that in mind, my perception of this article is that it contains some degree of arm-waving that “regulations are bad” and “the supposed benefits are not worth the cost/reduction in supply”.

To feed a more useful discussion, I think that a more granular review of the regulations in question would be appropriate. A similar article written from the opposite perspective might read something like “Developers cut quality and cost until falling sale prices (or rents) no longer generate an adequate return on investment”, or, perhaps regarding the environment: “Clean air regulations drive up the cost of transportation and goods”.

Similarly generically accurate; but not useful as anything other than an observation.

TSL

Micro-units are awful, having lived in one. They are demeaning in that they are the neoliberal dream of pods of workers with no family capacity, no guests, (rally…no one else can fir in those places physically). They are the least social form of housing ever conceived, more akin to a prison than a community.

Where is all the demand? Family-sized housing with ground-oriented access and backyards. Working families don’t have the time to externalize their costs to public amenities with dual-income households, so who Jr. wants to play outside, they need an immediate venue (backyard) to safely do so through passive guardian observation. Zico-units and most shared housing schemes are anti-family and are major interruptors in life accomplishments. They are a current fad and a dangerous, anti-social built form.

Yes, regulations drive up costs, and that is a poor outcome. But that is not the same as intensification which drives up demand for a fixed amount of land. That is the primary driver of land price increases by far: planning increases demand and then keeps supply static, howl building more walls between teeny units. That is why intensification is resisted and why fee-cutting appears to have little remedy for affordability. What one hand giveth the developer (intensification) the other takes away (fees), and the consumer still has increased demand for a smaller, less useful, anti-social product.

Raal 1960

I have worked for two different development companies, both reputable. Amongst my duties at one was to conduct project feasibility evaluations and establish a pro-forma. What this article says is so true – increased costs & fees result in projects not penciling and therefore not going forward, limiting supply – in the long run.

In the short term you can impose new fees and costs on a project already significantly started and the developer will likely end up eating those costs in reduced profit because they can’t change the market price.

In addition to the increased cost of construction and fees, another factor is the anticipated time to sale. If you invest $1 million and get a 20% return in 1 year that is great, if it takes 10 years to get that 20% return then you were better off putting your money in the stock market or another investment. In some jurisdictions complicated projects can take many years and that can have a major impact on project feasibility.

Mike O'Brien

Dan, a new house on our street in North Portland recently sold for $995,000 (listed initially at $1,300,000). Existing homes are being sold for more than the asking price. In today’s market, how does relaxing regulations or reducing fees lead to more affordable housing?