There’s much ado about expansion plans for Canada’s Trans Mountain Pipeline, and with good reason: exporting tar sands oil through the Salish Sea poses huge spill risks to the region. Now there’s reason to think that Washington may see a giant pipeline expansion of its own.

Kinder Morgan may also be planning to more double the size of the Puget Sound Pipeline, boosting its capacity from 240,000 to 500,000 barrels per day.

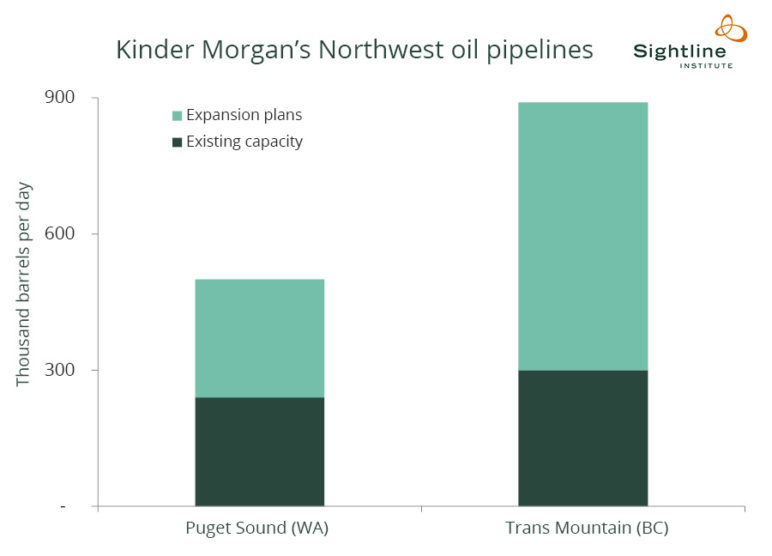

Kinder Morgan, an energy goliath with a checkered past, owns the Trans Mountain as well as the connected Puget Sound Pipeline, which runs through Whatcom and Skagit Counties in northwestern Washington State. The company is planning to begin construction this year on a near-tripling of its Canadian Trans Mountain Pipeline’s capacity—adding a new 590,000-barrel pipe alongside the existing pipe. The resulting “twinned” line would be bigger than the planned Keystone XL Pipeline. And south of the border, new financial disclosures indicate that Kinder Morgan may also be planning to more than double the size of the Puget Sound Pipeline, boosting its capacity from 240,000 to 500,000 barrels per day.

The existing Trans Mountain line delivers 300,000 barrels of crude oil daily over a 715-mile route from Alberta to the Northwest. Some of it goes to a marine terminal at Burnaby, British Columbia, where it is loaded on vessels for export to Tacoma, Washington, several locations in California, and other refining centers. Yet most of the oil, about 191,000 barrels daily, is diverted to a branch line known as the Puget Sound Pipeline, which delivers the fuel along a 69-mile route to four refineries at Ferndale and Anacortes, Washington.

In operation since 1956, the 16- to 20-inch pipeline that comprises the Puget Sound system has four breakout tanks, designed to store oil for later pipeline shipments. The Puget Sound Pipeline accounts for roughly a quarter of all the crude oil delivered to Washington, requiring approximately one day for the crude to reach its destination. The company has reported only five spills to state and federal authorities over the course of the pipeline’s lifespan and none in the past 17 years.

In 2012 and 2013, company officials hinted at possible expansion plans to the Puget Sound line—either in addition to the Trans Mountain enlargement or as an alternative to it if the BC route proved unworkable—but those ambitions seemed to have fallen by the wayside. After a 2013 expansion from roughly 180,000 to 240,000 barrels per day, Kinder Morgan appeared content to focus on growing Trans Mountain. In the meantime, the Puget Sound system continued to fill with Canadian oil, “with 2015 and 2016 experiencing increases from previous years of over 15 percent and 30 percent, respectively,” according to the company.

Yet new information contained in Kinder Morgan’s financial disclosures shows that the firm may be intending to more than double the Puget Sound Pipeline’s capacity. Looking to raise money to finance construction on the Trans Mountain expansion, the company’s Canadian subsidiary has filed for an Initial Public Offering. In at least five places in the marketing materials and prospectus documents, Kinder Morgan asserts that the Puget Sound Pipeline “is capable of being expanded to increase its capacity” to 500,000 barrels per day.

The company is pitching the expansion possibility to potential investors, presumably because expanding the Puget Sound line in coordination with Trans Mountain would enable the company to deliver more fuel to some of its prime destinations in the Northwest. And according to statements in the IPO filings, the expansion might also free up Alaska oil for export to foreign markets after the Obama Administration lifted the longstanding ban on exporting American crude oil. In other words, a Puget Sound expansion could indirectly act as a way for US oil producers to sell more oil abroad.

The state would likely be confronted with new challenges to protect local communities and sensitive ecologies from the risks of notoriously harmful tar sands spill.

Although Trans Mountain provides the sole pipeline link from Alberta’s oil sands fields to the Northwest, the existing line handles a variety of oil types. Historically, it has not been dominated by tar sands oil, which would comprise the bulk of the shipments in the planned Trans Mountain expansion. In 2012, for example, Kinder Morgan reported that the pipeline was carrying 45 percent light crude, 22 percent heavy crude (which could refer to an oil sands product), 16 percent synthetic crude (which could be a blended product containing oil sands), and 16 percent refined product (such as diesel or gasoline). But in the years since, oil extraction in Alberta’s tar sands region has boomed, and the planned Trans Mountain expansion is designed explicitly to deliver huge quantities of the sticky, heavy oil to export markets.

It’s reasonable to assume, therefore, that a twice-as-big Puget Sound line would likely carry large volumes of tar sands oil through northwest Washington, too. From its destination points at Whatcom and Skagit County refineries it would either be processed into useable consumer fuels or possibly loaded onto tankers for export. In either scenario, the state would likely be confronted with new challenges to protect local communities and sensitive ecologies from the risks of notoriously harmful tar sands spills.

Update 6/1/18: In its SEC filing for 2017 Kinder Morgan says that it could expand the Trans Mountain even more than currently planned, and the company reiterates its interest in doubling the Puget Sound line:

While we do not presently have any plans to expand TMPL outside of the current scope of TMEP, the combined capacity of the expanded pipeline could potentially be further increased by over 300,000 bpd to approximately 1.2 million bpd, with additional power and further capital enhancements. The Puget Sound pipeline is capable of being expanded to increase its capacity to approximately 500,000 bpd from its current capacity of 240,000 bpd. We will continue to monitor market and industry developments to determine which, if any, further expansion projects on TMPL may be appropriate.

This article benefited from research contributed by Alyse Nelson, John Abbotts, Carl Weimer, Matt Krogh, and Alex Ramel, and from editorial review by Tarika Powell.

[list_signup_button button_text=”Like what you|apos;re reading? Get our latest fossil fuel research right to your inbox.” form_title=”Fighting Fossil Fuels” selected_lists='{“Fighting Fossil Fuels”:”Fighting Fossil Fuels”}’ align=”center”]

Comments are closed.