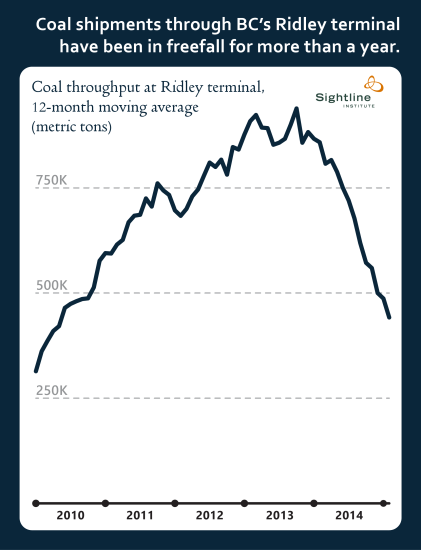

Take a look: coal exports through the Ridley terminal in northern British Columbia are in freefall:

It’s almost funny. Just a few years back, Ridley was so confident about its prospects that it undertook an ambitious plan to boost its throughput capacity from 12 million tons per year all the way up to 24 million tons per year.

At the time, the plan seemed reasonable: Asian demand seemed strong, and at least two new mine projects were slated to use Ridley’s extra capacity.

But fast forward a few years, and both new mining projects appear to be on indefinite hold…even as many of the terminal’s potential customers have shuttered their mines because of the sustained price collapse in Asian coal markets. As a result, Ridley is now on track to ship less than 6 million tons of coal this year—and possibly less than 4 million.

Instead of doubling their capacity, Ridley could have cut it in half, and they still might have room to spare.

To be fair, Ridley is likely to ship a dollop of petroleum coke from Canadian tar sands projects. Still, the chart above may actually understate Ridley’s difficulties. In February, coal throughput at the terminal fell to its lowest level since December 2009—a time when the global economy was in a shambles. And there’s no reasonable prospect for coal export volumes to grow substantially—especially not now, considering that Chinese coal prices recently hit an 8-year low. Given all of this bad news, it’s little surprise that Ridley halted its expansion half-way through.

[prettyquote align=right]Ridley coal terminal is a textbook example of a “stranded asset”[/prettyquote]The expansion at Ridley is a textbook example of a “stranded asset”—a significant investment in the fossil fuel economy that turns out to be unusable. What sets Ridley apart, though, is that it was a government project all along: Ridley is a Crown corporation, owned by the Canadian federal government. Ottawa has been trying to find a buyer for their albatross for years, with no success.

All of which raises an interesting question: given Ottawa’s experience with Ridley, why on earth is the Wyoming legislature so excited about getting into the Northwest coal terminal business? Do they really want to leave Wyoming residents on the hook for a risky project that could turn into as much of a financial albatross as Ridley has?

Comments are closed.