As Oregon and Washington contemplate a carbon tax or carbon cap, the oil industry is revving the engines for an astro-turf scare campaign here. The oil lobby spends a million dollars a month in California. As Oregon and Washington start thinking about holding them accountable, the oil lobby is turning its scare machine our way.

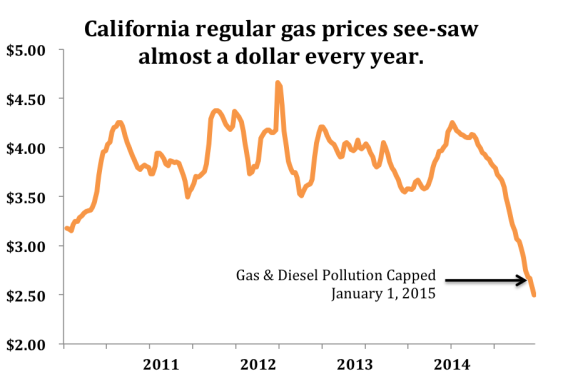

Governor Inslee has proposed a plan that would cap carbon pollution in Washington and move the state slowly but surely away from fossil fuels—away from what oil and coal companies sell—and onto clean energy. California has capped pollution from power plants and industrial facilities since 2013; when gas and diesel came under the cap this year, most economists estimated it would cost customers about a dime a gallon. But the powerful Western States Petroleum Association warned voters and legislators about a “hidden gas tax” that could cost families 76 cents a gallon of gas. Now that California has been holding polluters accountable for a few weeks, what has the price impact been? The price tag for clean air—maybe a few cents a gallon—was lost in the noise of gas prices that rise and fall ten times that amount every few months.

Original Sightline Institute graphic, available under our free use policy.

There are two things that Oregon and Washington can learn from Western States Petroleum Association’s “Wolf!”:

- Industry will try to scare us with hyper-inflated cost estimates. Oil and coal have a long history of over-blown cost estimates aimed at scaring decision-makers away from making oil and coal take responsibility for their pollution. Experience—with the Clean Air Acts of 1970 and 1977, the 1990 amendments, and now with California’s carbon cap—show that industry cost estimates are often way off-base.

- The cost of cutting pollution gets lost in the noise. The price of gas will almost certainly continue to fluctuate, whether we hold polluters accountable or not. A dime a gallon is less than the amount that gas see-saws up and down in an average month, and a fraction of the rollercoaster that gas prices ride in any given year. That seems like a fair price to pay for clean air, transitioning the Pacific Northwest to a clean energy economy, and doing our part to stabilize the climate.

Barry Saxifrage

I think we will see oil companies reverse themselves and embrace carbon pricing soon.

The reason is that coal and oil are competing for remaining carbon space in the atmosphere. The only way oil gets to use their proven reserves is if coal co2 disappears pronto. And the fastest way to get rid of coal is a carbon price. The US EIA GHG25 scenario shows this clearly. Brutal for coal…not so bad for oil.

Exhibit A in this battle is the newest energy annual from the American Petroleum Institute. For the first time they open up their pages to other energy sources. And not just any energy sources: seven low-carbon alternatives to coal. And the API lets each coal-competitor go hippy on climate threats and carbon pollution (over 50 mentions!). Now why would the oil industry hand over almost all their annual energy report to the electricity industry? And why invite the climate crusaders to hammer away?

Oil is going throw coal under the climate bus to maximize their asset values.

Craig Patterson

Thank you Barry for a fascinating analysis and it brings up a few questions. Perhaps you have some additional insights.

1) Do you see externalizations in other areas (health, air and water pollution) showing up directly in the pricing of these energy sources?

2) How will Charles Hall’s concept of Energy return on energy investment (EROEI) impact our energy future, short and long term?

3) Where might the ‘tipping points’ manifest?