Congressman Tip O’Neill famously said that “All politics is local.” Climate politics is no different. So it is with great enthusiasm that I link to the Washington State carbon tax swap calculator, a snazzy tool that allows you to evaluate how one particular carbon pricing policy—the revenue-neutral Carbon Washington tax shift—will affect your own individual household. The Carbon Washington proposal uses carbon tax revenues to reduce sales taxes and B&O business taxes. The calculator tool estimates your household’s carbon tax payments and your sales tax savings and boils it all down to a single dollar amount: an estimate of how much more or less your specific household will pay annually in state taxes with a $25 carbon tax shift. (As noted below, you can also tweak the calculator to see how Governor Inslee’s proposal will affect your household.)

Read on for a few of my observations, but the main point of this post is to encourage you to try it out yourself and post your results in the comments!

Full disclosure: I am a leader of the Carbon Washington group and helped create the calculator, with research assistance from Summer Hanson and Akua Konadu. Ultimately, however, the calculator is a project of UW computer science graduate student Justin Bare and is intended to be an impartial informational tool to allow Washington State households to evaluate the impact of a carbon tax on their household. The detailed methodology behind the calculator is available for your analysis and feedback.

Observation #1: For most households, the tax swap is pretty close to a wash.

Odds are that your household will pay a few hundred dollars a year more for fossil fuels (roughly split between transportation fuels and home energy use) and a few hundred dollars a year less for everything else. You could easily end up plus or minus $100 or $200, but results outside those bounds would be pretty unusual. (See below for a caveat about home energy use, and note one exception: low-income households with children who qualify for the federal Earned Income Tax Credit could end up ahead by a more substantial amount—about $1000—because they’d qualify for a Working Families Rebate that boosts their EITC by 25 percent.)

It’s worth emphasizing that plus or minus $100 or $200 is not much in the context of a state tax system that averages about $6,500 in state taxes per household. (Washington’s 2.6 million households pay about $17 billion a year in taxes. The state sales tax alone accounts for an average of almost $2,700 per household.)

Also worth emphasizing is that all households—win, lose, or draw—will have a strong financial incentive to reduce their carbon footprint. That’s because every ton of CO2 you can cut from your carbon diet will save your household $25. The more you manage to cut, the further ahead you will get under a tax swap.

Observation #2: The main geographic disparity is about electricity, not transportation fuels.

It’s tempting to think that the most important split is metropolitan versus rural, with the latter paying more because they drive more. This issue is complicated by the high mileage of suburban households—hopefully I’ll do another post on this later—but in Washington State, the most important split is actually about electricity: Investor-Owned Utilities (IOUs) versus Public Utility Districts (PUDs).

IOUs (Puget Sound Energy, Avista, and Pacific Power) provide electricity to about half the state and are much more carbon-intensive than the public utilities (principally PUDs, but also municipal utilities and cooperatives) that serve the rest of the state. To a first approximation, the PUDs and other public utilities are 100 percent hydropower, and the IOUs are the equivalent of 50 percent hydropower and 50 percent coal. So a $25 carbon tax will have almost no impact on the electric bills of PUD customers, but will cost a bit more than $100 a year for an average household served by an IOU.

The kicker is that the geographic split between IOUs and PUDs is quite haphazard. King County, for example, is split between Seattle City Light (which provides low-carbon electricity to customers in the city) and Puget Sound Energy, which provides relatively high-carbon electricity to Bellevue, Bainbridge Island, and most of the rest of the county… except for Ames Lake and parts of North Bend, which get low-carbon power from Tanner Electric Coop. The rest of the state is a similar mish-mash: embedded below (use the >> button in the upper left-hand corner to see the legend) is one GIS map estimate of the gory details. The calculator tool narrows down your options based on your zip code, but in some cases, you’ll need to look at your utility bill to accurately identify your utility provider.

Observation #3: The impact on airfares is likely to be surprisingly modest.

Airplanes get about 60 miles per gallon per seat (details in the methodology document) so a 2,500 mile trip from Seattle to New York amounts to a bit more than 40 gallons of fuel per person. A $25 carbon tax works out to a bit less than 25 cents per gallon of jet fuel, so the “carbon tax surcharge” on this flight would amount to about $10.

Observation #4: The calculator works best if you feed it high-quality data.

The more accurately you can estimate your carbon consumption, the more useful the calculator will be. That applies to household gasoline consumption—the calculator provides three different options for estimating this—and it applies even more strongly to household energy use. Although there is an option for estimating household energy use using information that is at your fingertips, you will get a much better estimate if you spend a few minutes to dig through your utility bills and generate an estimate based on those figures.

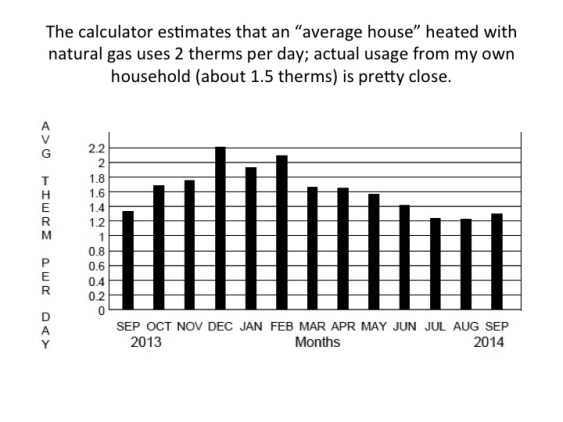

For example, the graphs below are from my own household’s utility bills. The calculator estimates that an “average house” with natural gas heat would use about 2 therms of natural gas per day, and the first graph shows that this is not too far off from my household’s actual usage of 1.5 therms per day. But the calculator also estimates that an “average house” with natural gas heat uses about 30 kWh of electricity per day, and the second graph shows that this is much more than my household’s actual electricity usage of about 8.5 kWh per day. (Apparently all those LED light bulbs and energy-efficient appliances are making a difference!)

Avg WA House Therm per Day. by Yoram Bauman (Not for reuse.)

Avg WA House kWh per Day. by Yoram Bauman (Not for reuse.)

Observation #5: You can tweak the calculator to estimate the impacts of Governor Inslee’s proposal.

Governor Inslee’s proposal is likely to result in an initial carbon price of about $12 per ton, with funding for transportation and education and a 10 percent Working Families Rebate. The calculator tool, which is based on the Carbon Washington proposal, uses a $25 carbon price and includes a one-percentage-point reduction in the state sales tax and a 25 percent Working Families Rebate.

Consequently, you can estimate the impacts of the Governor’s proposal by working through the calculator tool with the following tweaks: (1) ignore the sales tax savings; (2) divide any Working Families Rebate you get by 2.5; and (3) divide your carbon tax payments by 2. (Of course, you also need to think about the value your household will be getting from the transportation and education funding components of the Governor’s proposal.)

Observation #6: It only takes a few minutes.

So go try it out yourself and post your results in the comments!

Matt Leber

My household saves $171 per year despite dramatically inflating my household’s air miles to include our busiest flying year in the last decade.

My energy conservation hobby appears to save the day since it cuts into our electricity consumption.

I also compared the potential carbon tax paid for driving 12,000 miles in my wife’s Prius ($63 per year) vs 12,000 miles in my C-Max PHEV ($57 for my relatively dirty PSE electricity plus gas used to drive 12,000 miles 3468 kWh / 98.26 Gallons – YMMV )

Jeanette Henderson

The carbon tax calculator is super easy to use, and took me less than 10 minutes just like the website says.

My household saves $57 per year.

I was surprised because we heat our 104 year old house with the original furnace (converted from coal to oil some decades ago) and I thought for sure the carbon tax would sink us on that. Maybe it works out ok because we have only one car and don’t drive much, we don’t fly very frequently, and of course thanks to carbon free electricity from Seattle City Light.

For us, the big difference was with the sales tax. The first time I ran the numbers I was lazy and used the average rate the calculator showed. Then when I changed that to a more accurate amount for our household, the tax savings dropped significantly.

Based on the carbon tax calculator, and your excellent summary, looks like this is a policy we should support. Thanks Yoram!

Don Steinke

The billion dollar question is . . . should we work like hell to promote Governor Inslee’s Carbon Pollution Accountability Act, which he is championing right now?

If we don’t succeed, then work like hell this spring to help Yoram get his proposal on the ballot.

http://www.sightline.org/2014/12/18/why-the-carbon-pollution-accountability-act-is-a-big-awesome-deal/

http://www.governor.wa.gov/issues/climate/documents/CarbonPolutionAccountabilityAct2015_Z-0307.2.pdf