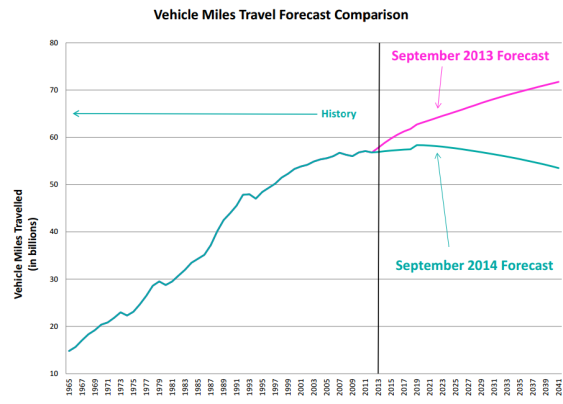

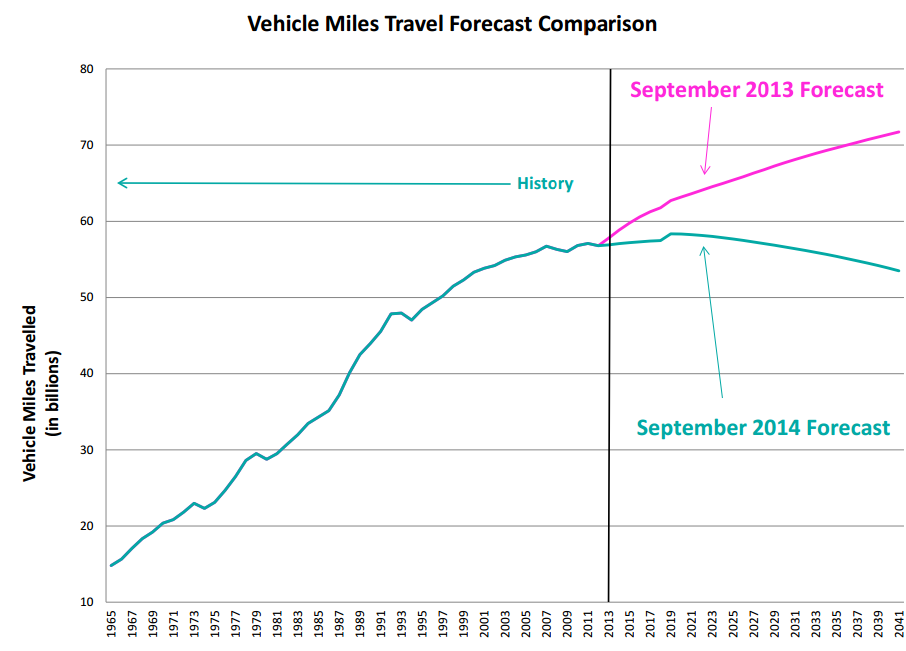

This is far and away the most responsible official traffic forecast I’ve seen from any government agency, ever:

It’s from a new transportation revenue forecast (pdf link, see p. 27) recently published by the Washington State Office of Financial Management. Their forecast from last September, in pink, assumed that traffic would grow endlessly, much as it did during the 1950s through 1990s. But the new forecast, in blue, assumes that the modest traffic growth of the past decade will continue, and will then be followed by a slight decline.

There are two reasons why this forecast is such a refreshing change. First, it reflects the growing empirical evidence of a long-term slowdown in the growth of vehicle travel, evident on major roads in Washington, for Washington State roads as a whole, for the US, and for much of the industrialized world.

Second, even if the forecast is wrong, assuming that traffic won’t grow much is the most fiscally prudent way to plan a transportation budget.

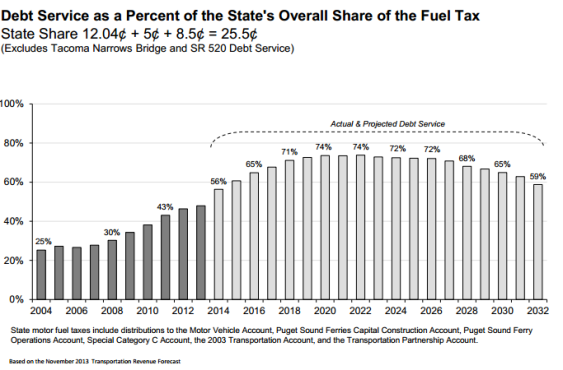

For far too long, “build now, pay later” has been the transportation budgeter’s mantra. In the 2000s, for example, Washington committed itself to massive road projects that it didn’t have the money to build. So the state floated bonds, assuming that revenue from gas taxes would show up to pay them off.

That hasn’t worked out so well. Traffic didn’t grow as expected, and gasoline and tolling revenue has gone AWOL as a result. Gradually, planners have come to realize that debt service will swallow up most of the state’s gas tax receipts, crowding out everything else. As the chart below shows, WSDOT predicts that within a few years three-quarters of the state’s gas tax receipts will pay for old projects.

And because so much of the state’s gas revenue is going to pay off old debts, state and local governments simply don’t have the money to keep existing streets and roads in good repair—let alone complete projects, such as the SR-520 bridge, that we’ve already started. And there’s even less money left for the transportation priorities where demand is actually growing, such as walking, transit, and biking.

When you find yourself in a hole, the first step is to stop digging. And that’s exactly what this new forecast does: it helps transportation policymakers stop digging all of us deeper into highway-fueled debt. By undermining both the rationale for new roads and the belief that we’ll be able to pay for them, a forecast of flat traffic should help inject a needed dose of reality into the state’s transportation debates.

Of course, there’s no telling whether this forecast will be right. As Yogi Berra allegedly said, predictions are hard, especially about the future. But if it turns out that this forecast underestimates traffic growth, budgeters won’t find it such an unpleasant surprise, since more traffic will bring more revenue from drivers. And at this point, finding a bit of extra revenue to deal with emerging problems beats what we’ve got now: not having enough money to pay for expensive solutions to problems that never really showed up.

(Hat tip to Ben Serrurier for pointing this chart out!)

Comments are closed.