The disaster in Lac-Mégantic, Quebec—where 47 people were killed by a Bakken oil train derailment—is commonly understood to have resulted from a train slipping its brakes and then rolling downhill into town where it crashed disastrously. It was a tragedy, but it should not be considered just a mechanical accident.

In truth, it was a self-reinforcing chain of events and conditions caused by underinvestment, lack of maintenance, and staff cutbacks. And it’s a lesson the Northwest should heed because it illuminates the risks of allowing small regional and short line railroads to pick up unit trains of crude oil from bigger railroads like BNSF and transport them short distances to refineries and terminals. The Northwest is home to at least two small railroads with big oil-by-rail aspirations. One already hauls oil trains several times a week through Portland and small towns in northwest Oregon while the other, plagued by a string of recent derailments, aims to service no fewer than three terminals at the Port of Grays Harbor.

The story from Quebec—of what happened to the Montreal, Maine & Atlantic (MMA) railroad—is the story of a disaster waiting to happen. MMA was a regional railroad assembled in 2002 by a holding company from the assets of bankrupt Iron Road Railways, which owned four small railroads operating in Maine, Vermont, and Quebec. MMA had struggled financially from the start just as its major customers in the forestry industry also struggled. It went through a series of cutbacks to staff and maintenance.

Increased traffic from oil-by-rail was going to be MMA’s ticket to financial stability. Instead, following the Lac-Mégantic wreck, MMA was forced into bankruptcy, leaving billions of dollars of cleanup and damage costs uncovered by its minimal insurance.

What happened was this. MMA picked up the ill-fated oil train of Bakken crude from the Montreal yard of a big player in North American rail, Canadian Pacific (CP), and was transporting it to a refinery in New Brunswick. The engineer parked the train on a hill above the town of Lac-Mégantic for the night. He is now accused of setting an insufficient number of hand brakes that were acting as a back-up to the train’s air-brake system and of not performing a brake test effectively. The hand brake issue only became a problem because locomotive 5017, which was powering the air-brake system for the entire oil train, was shut down.*

And the reason this locomotive was turned off? Because when it had caught on fire earlier in the night the responding firefighters had to turn it off.

And the reason it caught on fire? Chronic underinvestment by the railroad. According to court documents, MMA’s own employees point to underinvestment by the railway that led to the company using second-hand locomotives, operating rundown equipment, tolerating damaged tracks, and performing minimal maintenance. One worker testified that “he saw little maintenance done on locomotives and that locomotive 5017 was in particularly poor condition.”

On the night of the accident, locomotive 5017 was in such bad shape that it was actually spraying a fine mist of oil droplets into the air. In fact, the taxi driver who picked up the engineer reported that he had to “turn on his windshield wipers to clean oil from the windshield before he could start driving his car.” Then the locomotive actually caught fire a bit later on that night.

After the locomotive fire was extinguished, the engineer in discussions with MMA offered to return to the train to inspect it. Yet MMA turned him down, opting to have the engineer rest. (He had been awake for more than 17 hours.) Instead, the railway sent in his place an unqualified track maintenance foreman because, according to the accident investigation report, the company did not want the engineer to violate mandatory rest requirements and cause a delay in the following morning’s train departure time. A second qualified crew member was not available to inspect the train because in 2012 MMA was approved by Transport Canada to reduce its train crews to just a single person to save money—a move that the biggest Bakken hauler, BNSF, is rolling out on some of its freight trains (though not those that haul oil).

Are other small railroads ready to blow too?

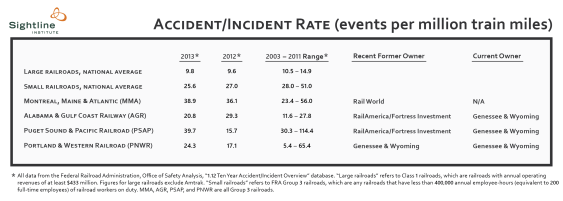

Data on accident/incident rates for a railroad can be an indicator of problems like poor maintenance and training. According to US Federal Railroad Administration statistics, in 2012, MMA had a rate of 36.1 occurrences per million miles, while the national average for similar sized railroads was 27.0, and for Class 1 railroads was 9.6.

MMA is hardly an isolated case of a financially beleaguered small railroad. There are other regional and short line railroads that have gone through consolidation into holding companies too. Across North America, financial difficulties, leveraged buyouts, and restructurings have lead to staff cut backs, as well as significant underinvestment in equipment and track maintenance. All of it calls into question their ability to haul crude oil safely. In fact, as a group, these small railroads have an accident/incident rate that is 2.5 to 3.0 times higher than Class 1 railroads.

Consider the Alabama & Gulf Coast Railway (AGR), a short line railroad operating on 350 miles of track from Mississippi to Florida. It serves a new oil-by-rail terminal built in Florida that transfers Bakken crude into a pipeline that feeds Gulf Coast refineries. Like MMA, AGR has gone through multiple changes in ownership, and it has been traded back and forth among railroad holding companies. Originally spun off from BNSF in 1997, AGR was owned by States Rail before being acquired by RailAmerica in 2002. In 2007, RailAmerica, which at the time held 45 short line railroads, was acquired by the investment management firm Fortress Investment Group. In December 2012, Fortress sold RailAmerica, including AGR, to Gennesse & Wyoming (G&W).

On November 8, 2013, an AGR train carrying Bakken crude derailed and exploded, losing 630,000 gallons in a wetland outside of Aliceville, Alabama. It was the worst crude oil train spill on record.

The accident, which occurred near a wooden trestle spanning the marsh, remains under investigation. Was the bridge poorly maintained and a cause of the accident? We may never know because it was incinerated in the accident. Months after the accident, a local environmental group is raising serious questions about the adequacy of the cleanup undertaken by AGR’s owner, G&W, having observed oil seeping from the hurriedly rebuilt rail bed and measured traces of oil moving downstream miles from the site.

Based on federal accident statistics, it would appear that the financial difficulties of AGR’s former owners, RailAmerica and Fortress Investment Group, led to similar declines in maintenance and investment as those that MMA experienced prior to the disaster in Lac-Mégantic.

The same players may be reenacting a similar story in the Northwest. The short line Puget Sound & Pacific Railroad (PSAP), formerly owned by RailAmerica and now owned by G&W, picks up BNSF trains at Centralia and runs them to Grays Harbor, Washington. It should be cold comfort to Northwesterners that PSAP would serve three proposed oil-by-rail terminals in Grays Harbor—and that the railroad has a 2013 accident rate on par with MMA’s. In May 2014 alone, PSAP saw no fewer than three freight train derailments within a two week period.

The new short line player

When Genesse & Wyoming (G&W) purchased RailAmerica and its 45 short line railroads, including PSAP, it became the largest regional and short line railroad operator in the US. It already owned Portland & Western Railroad (PNWR), which for the last year and a half has been picking up loaded Bakken oil trains in Vancouver, Washington and hauling them through Portland to the oil terminal near Clatskanie, Oregon on the Columbia River.

G&W operates over 100 railroads in North America. It is publicly traded and it is profitable, boasting $1.6 billion in revenues in 2013. It appears G&W is more of a true train operator than an investment management firm like Fortress. It has roots in the rail industry, having grown from one short line railroad in 1899 with 27 track miles to 15,000 miles of owned and leased track on three continents today.

Yet G&W only has $500 million in liability insurance, an almost laughably inadequate amount of coverage in the face of a serious accident. The total cost for rebuilding and cleaning up Lac-Mégantic, a small town, is now estimated at $3 billion over the next decade. The cost of an incident in a populated area like Portland or Aberdeen would be hard to calculate, but would assuredly be much higher. So much higher, in fact, that even if G&W was liquidated in bankruptcy to pay for damages, its total net worth of $2.1 billion reported in 2013 is not sufficient to cover the cost of a plausible worst case scenario accident.

In Alabama, where G&W’s train exploded, one could argue that it may have been difficult for G&W to make up in a short time for the years of RailAmerca’s neglectful ownership. But the clean up was all G&W’s responsibility, and by recent reports they have done a poor job of restoring a sensitive wetland. It’s a precedent that Grays Harbor would do well to bear in mind as the community evaluates whether to permit roughly 17 loaded oil trains a week to roll into town.

According to G&W’s annual report, the company expects to see growth in crude oil shipments in the United States as several new oil terminals come on line in 2014. Yet the short line assets they picked up in the RailAmerica acquisition have years of accumulated poor maintenance and underinvestment. So the question is: should G&W—with its radically insufficient liability insurance and poor oil spill cleanup track record—be allowed to ship volatile Bakken crude oil on small railroad lines with such high accident rates?

* Note that Canadian accident investigators subsequently found that even if the engineer had applied the minimum number of hand brakes required by MMA policy it “would not have provided sufficient retarding force to hold the train once the air pressure in the independent brake system was reduced” because there was a defective, malfunctioning valve in the brake system that the engineer didn’t know about, which required manual tripping; and handbrakes on “older locomotives, especially if not well maintained, can be more susceptible to reduced effectiveness.”

Comments are closed.