Oil-by-rail schemes are popping up across the Northwest and beyond, raising serious questions about public safety given that they have a nasty tendency to explode catastrophically. Even more worrisome, oil train numbers are increasing at a rate so astonishing that we cannot rely on historical trends or safety statistics. To illustrate the new era of freight rail, I put together four charts drawn from data published by the American Association of Railroads.

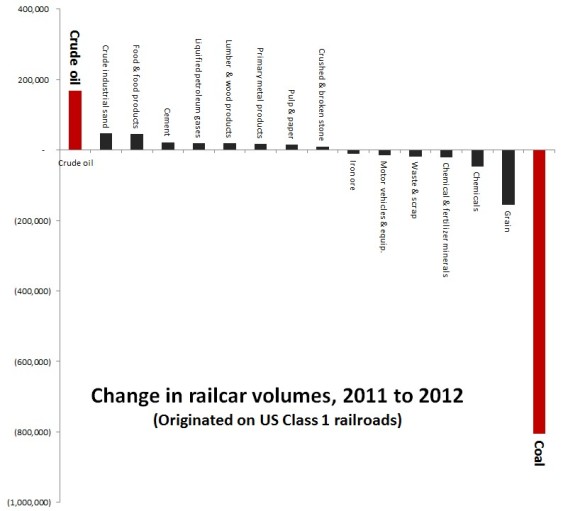

Oil is far and away the fastest growing type of freight hauled by rail in the US (although its increase does not come close to offsetting the recent precipitous decline in coal transport).

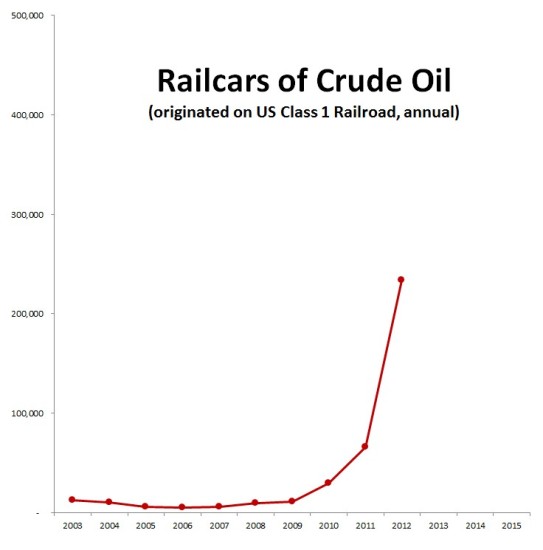

From 2009 to 2012, oil by rail volumes multiplied more than 21 times, from fewer than 11,000 railcars nationally to well over 230,000:

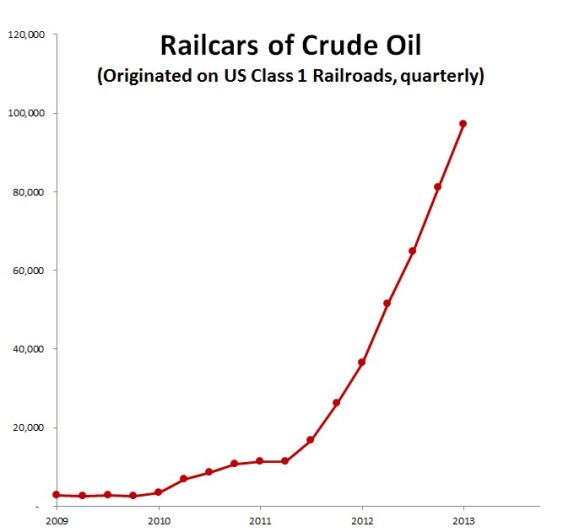

The skyrocketing growth rate of oil trains is continuing in 2013. The most recent quarterly data shows that the first quarter of this year saw more than 2.5 times as many oil railcars as the first quarter of 2012:

The skyrocketing growth rate of oil trains is continuing in 2013. The most recent quarterly data shows that the first quarter of this year saw more than 2.5 times as many oil railcars as the first quarter of 2012:

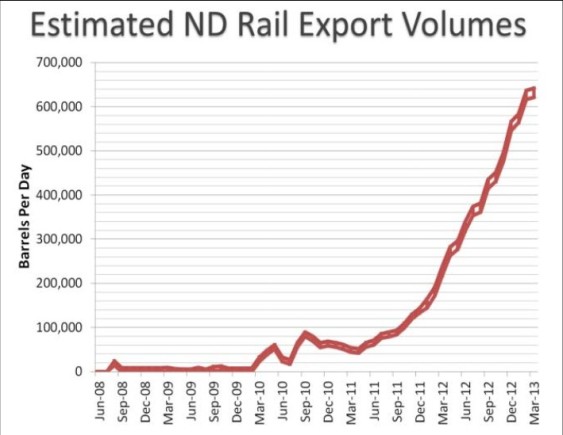

In North Dakota, home to the majority of Bakken oil extraction and originator of most oil trains, the growth in crude oil shipments has been staggering, growing more than sixfold in a little over a year:

https://www.aar.org/keyissues/Documents/Background-Papers/Crude-oil-by-rail.pdf.

Because the growth of oil trains has happened so suddenly, neither the public nor the industry should rely on historical trends or safety statistics. The simple fact is that the US has never experienced large-scale oil-by-rail movements to the degree that we are now.

Notes. All data in this report come from Moving Crude Oil by Rail, a report from the American Association of Railroads. The data shown in the charts here are conservative because they do not count crude oil shipments originated on railroads in Canada or on US short rail lines.

Comments are closed.