Not only in terms of graphic design, but in terms of the actual contents:

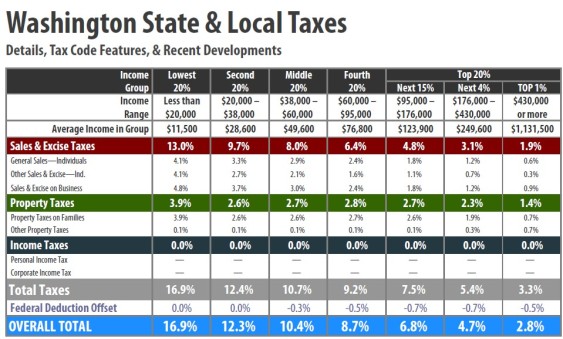

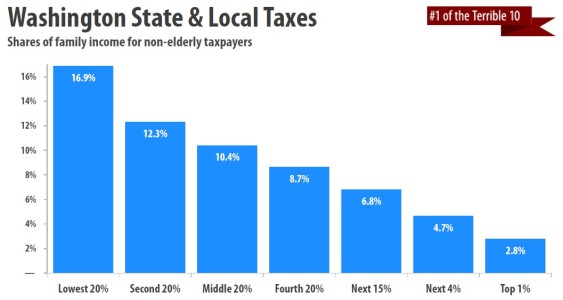

If you’d like to spend some time being appalled by a state tax code that manages to substantially worsen an already serious problem with income inequality… well, then feast your eyes on this new report from the Institute on Taxation and Economic Policy.

Washington retains its leadership status as having the most regressive tax structure in the entire United States. In fact, no other state really comes close.

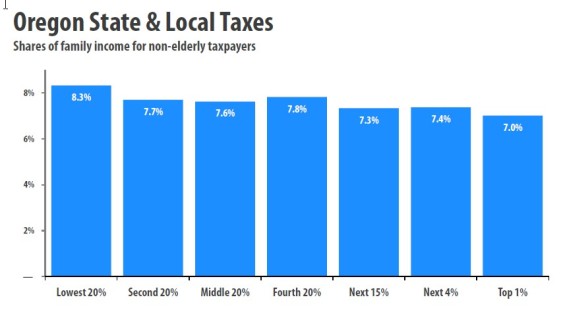

By way of comparison, Oregon’s tax system ranks as one of the least regressive states. Here’s what the same analysis looks like south of the Columbia River.

H/t to Goldy. Also check out the Washington Budget & Policy Center’s take on the findings.

Comments are closed.