The US Energy Information Administration released new numbers today, with shocking news for the coal industry: the nation’s electric utilities used 18 percent less coal in the first half of 2012 than they did in 2011, and 27 percent less than they did during the peak year, 2008.

In short, big coal companies are in the middle of a free-fall, and nobody’s sure when they’ll hit bottom.

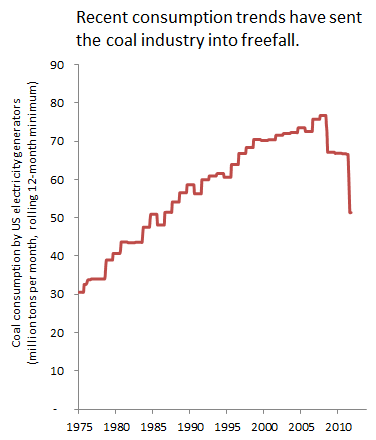

The chart to the right shows one way of looking at the trends: it depicts the minimum monthly coal consumption by the US electric power sector over a rolling 12-month period. And as of April of 2012, monthly consumption had fallen to its lowest level since 1986!

The chart to the right shows one way of looking at the trends: it depicts the minimum monthly coal consumption by the US electric power sector over a rolling 12-month period. And as of April of 2012, monthly consumption had fallen to its lowest level since 1986!

In all my years of examining economic and environmental trends, I’ve never seen anything like this. Gasoline consumption might shift by a few percentage points per year at most. Coal consumption trends had been very much of that ilk: consumption would shift slowly, but with a long-term trend towards steady growth.

So a drop of this magnitude is a proverbial “black swan“—an unforeseeable event with dramatic, world-changing consequences.

These trends are great news for the climate and human health, since coal is by far the dirtiest of all fossil fuels. Declining consumption means less mercury in our kids’ bloodstreams, lower levels of smog and acid rain, and less long-term risk to the climate. And the collapse in coal consumption is a major reason that US climate-warming emissions from fossil fuel combustion fell to a 20-year low earlier this year. (Yes, that’s right, because of declines in both coal and petroleum combustion, the nation’s fossil-fuel emissions earlier this year fell back to where they were in about 1992.)

But for purveyors of the nation’s dirtiest fuel, the trends come as a disturbing wake-up call, because they underscore the fundamental fragility and riskiness of what had looked like a stable and profitable industry. And if anything, coal’s collapse is accelerating: consumption slumped during the economic downturn in 2008 but dropped even faster during the recovery.

Coal’s troubles can mostly be traced to a single cause: a boom in natural gas. High gas production has sent prices tumbling to historic lows (after adjusting for inflation). They’re so low that many utilities are now shunning coal power plants in favor of efficient gas-powered turbines. The chart below from the US Energy Information Administration shows that natural gas generation (the green bars) has cut deeply into coal’s share of the generation market (blue bars) over the last few years.

From a climate perspective, of course, the trends aren’t all rosy. The decline in natural gas prices can be traced to fracking—a production technique that carries substantial greenhouse emissions risks and contributes to other environmental problems as well. Meanwhile, domestic coal companies are looking to offload their unwanted coal on overseas markets; in fact, CO2 emissions in the EU are now on the rise, as cash-strapped European nations are importing cheap US coal.

Regardless, what may be most fascinating about all these trends is how little notice they’ve received from the national press. Just look at the trends: there’s a fundamental, structural shift afoot in the energy industry. But it’s almost as if nobody except for a few energy geeks and coal investors have noticed. Which suggests that the coal industry’s mantra—that it’s a vital and indispensable contributor to the nation’s economic wellbeing—might be little more than empty talk.

pat milliren

Are you able to do any research about the combined environmental impacts of natural gas vs. coal impacts? I realize there are several if not many factors on each side of the equation.

As I understand it, the fracking has huge negative impacts on water, which is becoming an endangered resource in itself before fracking. Is there any other way to get natural gas? I have a hard time saying that trading coal for natural gas is good when water is in the balance. How can we do this better?

Clark Williams-Derry

Great question. The quick answer is: no, not without a lot of work. I think the fracking is being pretty well studied, and I have no personal knowledge or intuition that might help me figure it out.

Personally, I’m somewhat less concerned about water than I am about fugitive methane emissions — basically, releasing methane, a potent climate-warming gas, into the atmosphere. But that probably reflects my own obsession with climate change.

Agreed, we can do better. All it would take is putting a price on carbon emissions — which would put both coal and natural gas at a disadvantage to renewables and efficiency.

Leif Brecke

Unfortunately, coal is getting less popular because fracking is getting more popular.

“Gas from the hydraulic fracturing, or fracking, wells in the eastern U.S. has flooded the market and slashed the price of natural from $7-$8 down to $3 per unit over the past four years, reported the AP. That made gas cheaper to use than coal. Since natural gas produces less carbon dioxide and other pollutants when it is burned as compared to coal, more natural gas use has resulted in less environmental contamination.”

Correction, less carbon pollution. Fracking is extraordinarily bad on the environment.

Source: http://news.discovery.com/earth/co2-pollution-down-to-1992-levels-in-the-us-120821.html

Leif Brecke

Another interesting question is if that decreased carbon emission is only domestic and therefore, in addition to increased fracking, be attributed to increased foreign carbon emission following the manufacturing jobs.

matt picio

It’s interesting – not all the decline is due to electricity. Your graphs show coal consumption declining 33% in the last 5 years, while US electric utility use of coal only declined by 18%. That’s only a bit more than half the decline. Presumably, the other half is industrial use and exports to other countries? It seems very curious that companies want to build a major export port in the Pacific Northwest when coal exports may be declining.

Bob Becker

Concerning the Pacific Northwest, I live in Oregon. The coal industry has plans for exporting coal to Korea! From ports that need to be built up to handle the coal trains. Cities in Oregon are against coal trains coming through. City Councels in Portland and Eugene, more I think have voted against coal trains. Uncovered coal train cars create coal dust that blows off the cars.Polluting the air and land and rivers. Plus we certainly do not want the coal to be shipped to Korea. For this would contribute to Global Warming. I understand the same issue is being fought in Washington State.

David

Global warming was fabricated to slow our economy down and allow others to catch up. You will see no such large scale opposition to sending coal to Korea.