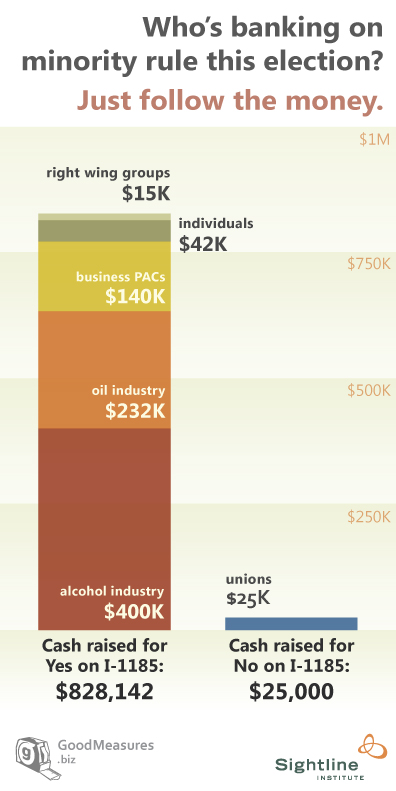

If you need evidence that money has a corrupting influence on politics, look no further than Tim Eyman’s latest ballot measure in Washington, Initiative 1185.

Overwhelmingly funded by heavyweight industries—oil and alcohol in particular—1185 would (re)institute a damaging form of minority rule in the legislature. It would renew an impractical two-thirds super-majority vote requirement to raise any tax—no matter how small or how necessary—or to close any tax loophole.

Needless to say, the initiative would allow a simple majority of legislators to open new tax loopholes.

At a time when core government functions in Washington are at a breaking point—education and transportation, in particular—1185 amounts to a kind of exemption from the public interest. Under 1185, an industry can protect even its most absurd tax loopholes simply by persuading a bare 34 percent of legislators in just one of the two legislative houses. As the campaign funding makes abundantly clear, 1185-type measures are really just ways to stack the deck in favor lobbyist-rich industries and against state residents.

Fortunately, in something of a reversal from recent minority rule initiatives, 1185 appears to be losing support with the electorate fast. Over at Crosscut, Doug MacDonald has an explanation for why 1185 is proving surprisingly unpopular with state voters. In short, it may be becoming clear just how much minority rule distorts democracy.

At the conservative Washington Policy Center, however, Jason Mercier has a head-scratcher of a blog post arguing that 1185 is not undemocratic. Yet it’s awfully hard to see what’s democratic—or just plain fair—about giving veto power to a minority of one-third (plus one) of the members of either the state House or Senate. Should one-third of just one house be able to veto the elimination of tax loopholes that shower public resources on car dealerships, bull semen, laser interferometer gravitational wave observatories and dozens of other business and commercial activities? Should one-third of either house be able to prevent collection of the revenue needed to fulfill the state’s constitutionally mandated “paramount duty” to fund your community’s schools?

It hardly seems right that a Washington, DC-based alcohol trade group and huge Texas-based oil companies can effectively buy themselves special exemptions in states where they reap big profits.

Thanks to Devin Porter for graphic design. “Cash raised” figures come from the Washington State Public Disclosure Commission and are current as of September 17, 2012. For the sake of simplicity and clarity, the graphic uses “Yes on 1185” to refer to the “Voters Want More Choices” campaign committee.

Comments are closed.