I’ve said it before: energy prices are going up no matter what, with or without climate policy. But smart policy can turn rising costs into broadly shared benefits. It can shield working families, fund a shift to a clean future of new technologies, compact communities, and a trained, green-collar workforce.

Building economic fairness into climate policy is a no-brainer: there are several viable ways to make it happen. In my last post, I described a means to it called “Cap-and-Dividend,” in which most public proceeds from auctioning carbon emissions permits finance a program of payments to each citizen. Another approach that shields working families from high energy prices comes from Robert Greenstein, founder and chief of the Center on Budget and Policy Priorities. CBPP is the Washington, DC-based think tank that bird-dogs the federal budget on behalf of poor families. Greenstein wrote the plan with colleagues Sharon Parrott and Arloc Sherman.

In short, in this plan climate dividends go only to families with very low incomes, to buffer them from cost increases. It’s Cap and Dividend, but only families who need it most get a dividend. Call it “Cap and Buffer.” Greenstein suggests compensating the poorest fifth of families for energy price increases and also providing some assistance to those in the second fifth of the income ladder. These families, according to Greenstein, stand to pay between $750 and $950 extra each year for fuel and other goods, once climate policy boosts energy prices enough to reduce emissions by an initial 15 percent. (Without climate policy in place, the only dividends from rising prices are going to energy companies.)

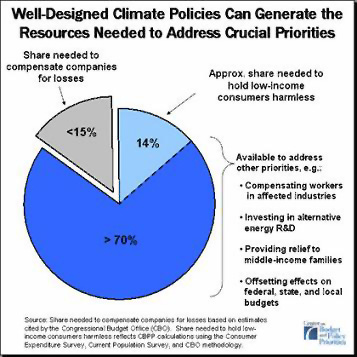

The good news is that Cap and Buffer isn’t an exorbitant proposition. Auctioning greenhouse gas emission permits would generate seven times more money than would be needed to cover the extra costs for poor and near-poor families.

Greenstein and his coauthors pay special attention to the practicalities of delivering money to millions of poor families in the United States. They write:

“No single mechanism is likely to reach most of the low-income population. Fortunately, there are two existing delivery mechanisms that, between them, can largely accomplish this task: the Earned Income Tax Credit (EITC) and the electronic benefit transfer (EBT) system that states already use to provide various types of state and federal assistance [such as food stamps and Medicare’s prescription drug benefit] to low-income families and individuals through a debit card.”

EITC and EBT debit cards could together reach three-fourths of eligible low-income US families immediately and a greater number later, as outreach campaigns bring more and more families onboard. Other mechanisms can’t match that promise—I’ll explain why below.

One plus of Cap and Buffer—as shown in the chart above—is that it leaves 85 percent of climate-pricing proceeds for other public purposes. Greenstein mentions things like clean-energy research, transitional assistance for fossil-fuel workers, and cost-covering budget increases for schools and other public agencies whose energy bills may rise. If lawmakers choose, Greenstein volunteers, they could expand income assistance to middle-class families by enacting a progressive payroll tax refund instead of, or in addition to, the EITC. In this way, the climate dividend could go to people further up the income ladder.

Cap and Buffer is both elegant and practical. It matches funds neatly to needs. It would be easy to administer once passed. And it has a frugality about it that I like.

What’s more, the states and provinces of Cascadia could get started on Cap and Buffer right away—without waiting for action from Washington, DC or Ottawa. Oregon already has its own earned-income tax credit on its state income tax, to which legislators could add a climate-pricing dividend. British Columbia, California, Idaho, and Montana have income taxes to which they could add earned-income tax credits.

Washington, which lacks a state income tax, could achieve the same result through a Working Families Credit, as recently proposed by the Washington State Budget and Policy Center. This ingenious proposal would involve distributing payments to state residents on the basis of their federal income tax returns.

Cap and Buffer has administrative advantages over Cap and Dividend. Still, it has a political disadvantage. The poorest fifth of families—or even the poorest two-fifths of families—may lack the political muscle to defend a climate dividend.

Dividing the proceeds from auctioned cap and trade could become the political version of an exploding piñata: everyone rushing to secure what they can. The climate-pricing piñata may have hundreds of billions of dollars in it. That’s plenty to go around, but advocates for low-income families often don’t fare well in such contests.

Their best hope may be in allying themselves with advocates for more-powerful groups such as the middle class. Their argument, in essence, would be that everyone at the party should get an equal share of the piñata. That is, Cap-and-Dividend.

This argument is one side of a long-running strategy debate among antipoverty advocates: should benefits only go to people in need (to meet those needs as cost effectively as possible) or should they go to everyone (to build a political base strong enough to support the benefits)? The latter approach, sometimes called “majoritarian,” favors social insurance programs that help both middle and working classes.

Such programs include some of the most successful economic fairness initiatives around, such as unemployment insurance and Social Security. Indeed, there’s no political substitute for the buy-in of the middle class. Europe’s social safety nets are largely majoritarian, not poor-focused, and that may be why Europe has so much less poverty than North America.

Cap and Buffer is poor-focused; Cap-and-Dividend is majoritarian. It creates a new guarantee to citizens that would help low-income families the most but would also help other families. Once enacted, it would be politically difficult to take away.

I’m not taking sides in this debate, though I lean toward the majoritarians. I’m just happy to report a second way to mitigate climate pricing’s financial cost to working families.

A third way is to help families save money through better energy efficiency. I’ll write about that soon.

P.S. For the public administration wonks, here’s a summary of Greenstein’s arguments against some other administrative mechanisms for distributing climate-pricing mitigation money to working families.

Can we distribute it through the US Low-Income Home Energy Assistance Program (LIHEAP)—a long-running program that helps some hard-hit families heat and cool their homes and also contributes to energy efficiency upgrades for them? Boosting LiHEAP makes sense, but it can’t do the main job. The program misses the vast majority of working families.

Through utility companies’ bill-payer assistance programs? No. Utilities don’t know who is low-income. Plus,

most of the effects of climate pricing won’t be on utility bills.

A new federal agency? No. Needless duplication and administrative cost.

A payroll tax rebate? No—or not exclusively. More than half of the lowest income families pay no payroll tax. They’re retired or disabled. Besides, a payroll tax rebate for low-income families would essentially have to be distributed through the income tax filing system, and many low-income families do not have to file income tax returns.

A refundable income tax credit? This is one way a Cap-and-Dividend might work: rather than distributing checks to each family separately, it would be rolled into the income tax system. Middle- and upper-income families would get their climate dividend as a reduction in their tax bill. Low-income families would get them as a tax refund—even if they hadn’t paid income taxes. (That’s what makes it “refundable.”) Greenstein dismisses this idea, because many low-income households do not file income tax returns. Smaller, state-based credits have not succeeded in motivating low-income families to file returns in order to get refunds for which they qualify. (I’m unconvinced by this argument. Under Cap-and-Dividend, payments to families might be easily $700 per person. I think that’s enough money to motivate most people to file a return. In fact, it seems to me that Greenstein’s delivery mechanisms for low-income families mesh nicely with Cap-and-Dividend: most folks get their dividend through a refundable income tax credit, very poor families also get a climate dividend on their EBT debit card.)

P.P.S. Is the term “Cap and Share,” which is employed in Ireland, better or worse than “Cap and Dividend” or “Sky Trust”? What do you think? Do you like the term “Cap and Buffer”?

eldan

I prefer “Cap and Share” because it feels like more positive framing than “Cap and Buffer”, while “Sky Trust” sounds a bit too ‘out there’ and easy for opponents to lampoon.

Jan

I think giving money to the poor, while admirable, misses the mark. I think people should be rewarded for using fewer resources, which the poor generally (but not necessarily) do.Imagine if any of these programs were qualified or prorated by how far you drive to work, what your fuel economy is, how you set your thermostat, what sort of food you buy. Perhaps hard to enforce, but it hits the mark better, no?Actually, I must admit to conflict of interest here. We currently operate our small Permaculture farm as a carbon sink, and yet we would reap no rewards from any of these proposed programs, which are all targeted at big business.Until you involve the common people, things will not change. Very few people voluntarily operate as a carbon sink. Address the demand side of the carbon equation with real, significant rewards, and watch how quickly people “buy in!”

Alan Durning

Jan,That’s a pretty hard-hearted position to take. Sort of “let them eat cake.” Climate change and higher energy prices both heap misfortune on the less fortunate. Our climate policy should hold harmless those least to blame and with the most to lose from climate change.Meanwhile, a Cap and Trade system—of any type—might reward carbon sinks. The challenge is to quantify, verify, and certify the permanence of the sink. I believe we can do that. At that point, a sink becomes a tradable commodity. You can sell the carbon storage to the highest bidder (Exxon?) or donate it to a nonprofit climate protection organization.But tradable carbon sinks are probably something we’ll add to Cap and Trade after we’ve already worked out all the details of covering as many sources of emissions as possible. Sinks are a little harder than sources.At least, that’s my 2 cents.

Morgan Ahouse

Jan – Currently, there is a reward for using fewer resources – one’s energy budget falls with lower energy consumption. This is the entire premise of an energy tax and the entire reason why we each limit our spending. Of course, we recognize the price of energy is an insufficient dis-incentive to consumption, thus the policy discussions. CBPP’s Cap & Buffer concept would add to this signal for everyone, though. The savings signal from consuming less would increase, because energy prices will increase (not to mention everything else). At the same time, the lowest fifth would be compensated for its average cost increases for all goods and services, as I read it. Those in this quintile who reduce consumption will benefit more financially than without the program. They will be net winners (assuming that the 14% redistribution figure is accurate). Those whose budget increases equal the dividend will see no change in their budget. If the program is set up to wash out, those who make no change in their behavior and consume at the group’s average will see no change in their budget, as I understand it. The critical feature is that energy prices will go up more than other goods and services, thus putting more downward pressure on consumption in this area of the economy.As far as being rewarded extra for specific behavior changes, that is really hard. You’re talking Big Brother stuff, which is currently impractical and generally rejected as undesirable. Still, a little while back, Eric de Place posted the notion of a car tab fee-bate based on your vehicle’s rated efficiency. And, there is the variable insurance concept, which gets a great deal of play at Sightline.I hear you though; I want to be paid to pedal my bicycle extra.

Morgan Ahouse

Alan, are you going to write about carbon sinks and justice/equity?This is a huge issue across the globe, especially as relates to the voluntary, offset market.In general, I’m concerned about the sink side of carbon markets and reading up on it. right now even.

Alan Durning

bahouse,I’ve got a long list of topics I’d like to write about (once I understand them well). Sinks are on the list. But they’re pretty low on the list. I wrote about them years ago, in Green-Collar Jobs. And Clark has posted a few times on NW forests as sinks.How they fit into a Cap and Trade system is something we’re not doing much about right now: still trying to work out the mechanics of pricing the major sources.

Barry

“These families, according to Greenstein, stand to pay between $750 and $950 extra each year for fuel and other goods, once climate policy boosts energy prices enough to reduce emissions by an initial 15 percent.”This makes it sound like CBPP folks know what carbon price will lead to 15% ghg reduction. Since we have never seen a 15% ghg reduction in USA or Canada, I’m wondering how they are so sure of their numbers. I again go back the gas price increases in recent years in NW of 230% that, according to Sightline article, has lead to ZERO ghg reduction from gasoline.Can someone point me to an example of an increase in a fossil fuel price leading to any significant decreased usage in USA or Canada? How big an increase was needed to get a particular ghg reduction? Everywhere I look, fossil fuel prices have been rising relentlessly and yet total ghg emissions keep going up. Another such example is flying emissions. Fuel prices are skyrocketing and emissions are too.Are the CBPP really on firm ground here?